I know what you might be thinking:

“How can I get more accurate entries on supports and resistances?”

“How can I become a better trader?”

Well, I want you to focus on these points:

#1 The best supports and resistances are drawn from a single peak

Let’s face it…

The more you wait to act on something, the later you’ll tend to be.

That’s the same with supports and resistances.

Why wait for two, three, or four touches before drawing a support or resistance level?

When you can draw them the first time the price peaks.

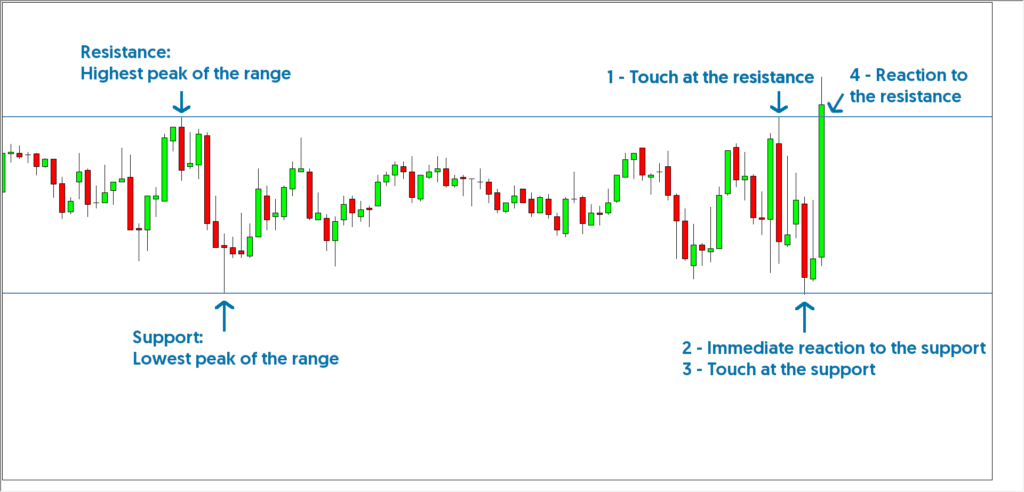

Like this example of a range:

The earlier we identify a support or resistance, the earlier we will be able to trade it.

That means when the level has the biggest strength.

When our odds of success are bigger.

Not after it’s been touched several times.

We want to capture the very first reaction to a support/resistance level.

Now watch what happens when each level is hit for the first time:

Did you see it?

The moves were so fast that the price went almost straight to the other side of the range.

Now you may be asking…

“How do I enter?”

#2 The price speed matters

In small ranges, you can’t wait for confirmation candles

Because if you do it, you’ll lose a bunch of the move.

After touching the support and resistance levels the price just reacted really fast.

The next close was already past the mid of the range.

“So do I enter as soon as the price touches the level?”

Not always…

Let me explain.

Strong reactions come from strong moves.

You want to see the price reaching the support/resistance really fast.

Ideally with a big solid candle.

Or even better…

Several in a row.

A move coming from a pullback that was far away from the resistance.

That’s the key to being able to trade a resistance aggressively.

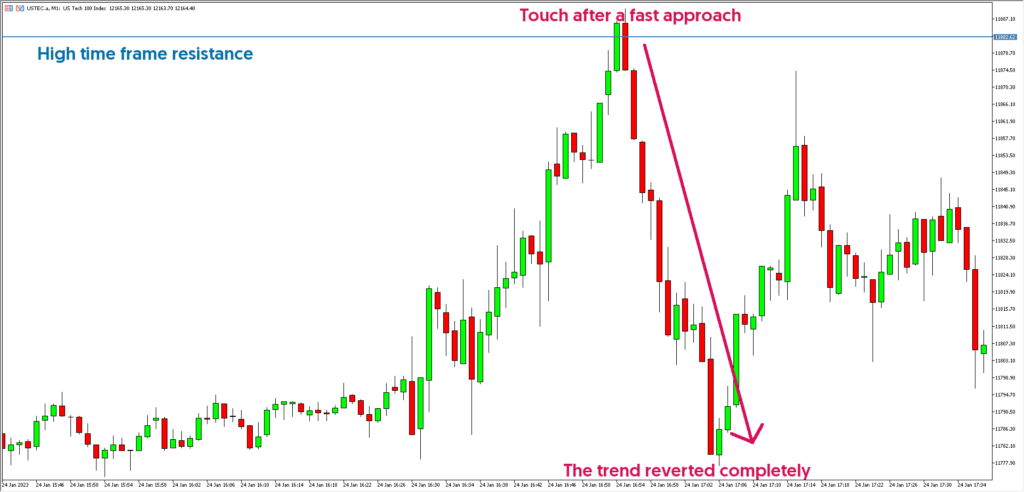

Look at this example from the M1 time frame with a resistance from H1:

That will configure a kind of exhaustion, where the price will tend to revert really fast too.

And remember, to trade aggressively, the first touch is always the better.

The more we wait, the closer we’ll be to the break and failure of the support or resistance.

“Great, I’ll draw lines on every place where the price made a swing low/high.”

Not so fast.

#3 It must make sense from a higher time frame point of view

Ideally, we want to trade levels that have the potential to make the price move a lot.

Let’s say that you are trading Dax.

And let’s say that Dax makes an average of a 10 points move on the M1 time frame, and a 100 points move on the H1 time frame.

If you trade a resistance from M1, it’s unrealistic to expect to catch a 100 points move.

But it will be more realistic if you traded a resistance from H1.

Here’s an example:

Can you see how different are the reactions expected?

The best thing about this is that we can aim for much bigger moves while risking the same number of points.

Let’s go to the first example again.

Would you trade that small range?

You could but…

What if you waited for a resistance from a higher time frame?

And there was one there just above:

And the move was brutal.

It had room for a 1/20 or 1/30 risk/reward ratio trade.

How cool is that?

So, what are the advantages of using higher time frames to trade resistances and supports?

- Your stop loss has the size of a low time frame candle

- Your take profit has the size of a high time frame move

- You can be more aggressive

- You can get risk/rewards like 1/10 or even more

This is like, risking an M1 candle to target an H1 move.

Or H4, or Daily…

Recap

- The best supports and resistances are drawn from a single peak which was not tested yet

- We can expect bigger reactions from the higher the time frame supports and resistances

- Aggressive entries work better after aggressive moves against the support/resistance

- Using higher time frames we can get really big rewards by risking just a small amount