I know what you might be thinking:

“How do I trade like a real snipper?”

“When can I get the most accurate scalping trading setups?”

“How do I become a better trader?”

Well, I want you to focus on these points.

If you are a scalper:

#1 You’re focused like an eagle

Imagine that you’re playing tennis with a friend.

Every time that the ball comes against you, you need to be prepared.

It can go to any side of the field.

And it will probably come very quickly.

What if at that time…

You’re looking at a girl (or man) that is watching you?

Well…

You’re not prepared to react quickly enough.

And either you miss the ball…

Or you get hit by the ball in your head…

When scalping it’s the same thing.

You trade very small time frames.

Do you have your screen like this?

When trading the 2-minute, or even the 1-minute time frame.

The action happens very quickly.

The lower the time frame the quicker.

And you know…

A small delay of just a couple of seconds can be the difference between being profitable or not.

When you are scalping you can’t take your eyes off the screen.

And how many pairs/stocks/indices should you watch at the same time?

The minimum possible.

I personally don’t look at more than two at the same time.

Most of the time it’s just one.

By doing that you’ll:

- Know exactly how the market is moving at every second (and what may be the next move)

- Avoid “losing time” constantly looking at other markets and refocus again and again

- Be completely concentrated and not overwhelmed with all those other charts moving at the same time

When you lose your focus…

When you are always jumping from market to market…

You end up forgetting what any of them is doing.

You have a higher chance of missing great trading opportunities.

And you’ll also probably take trades by impulse.

This may completely ruin your trading performance.

#2 You trade during the right time of the day (hint: that’s when most “gurus” tell you to stop trading)

I bet nobody told you this before.

Actually…

I believe that you’ve been told exactly the opposite.

Like:

“Wait 30 minutes or 1 hour after news releases to open trades”.

“High volatility is very dangerous to trade”.

Well…

This is just non-sense.

As traders, and especially scalpers…

We WANT volatility.

Volatility makes the price create the most accurate setups.

Volatility makes the price move.

Instead of being sideways and messy…

So what are the best moments to take quick trades?

Economic news releases

Well…

Not all of them…

Just the ones with high impact.

Why?

Because they tend to produce huge moves!

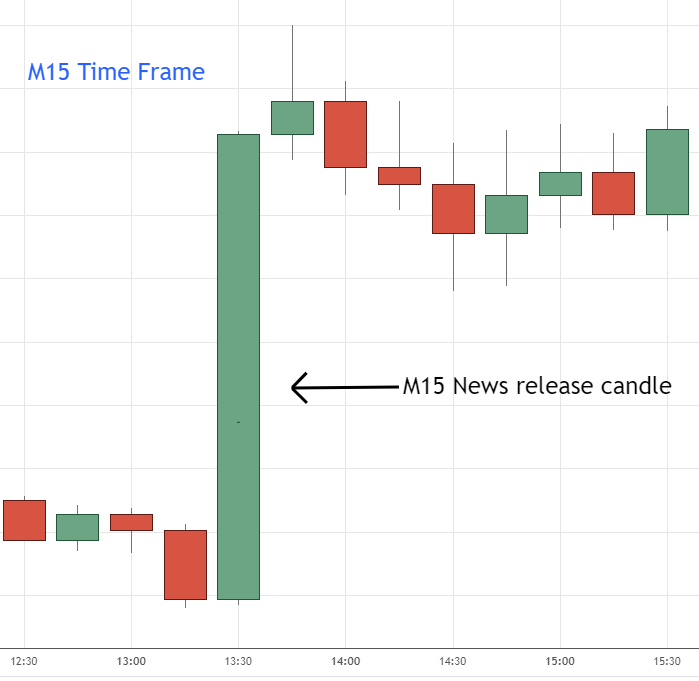

Have you ever watched a 15-minute candle after news releases?

I really big one, like this:

Look, I’m not telling you to place trades BEFORE the news is released.

Instead…

Be ready for the news…

Wait 1 or 2 minutes…

And then you’re ready to go.

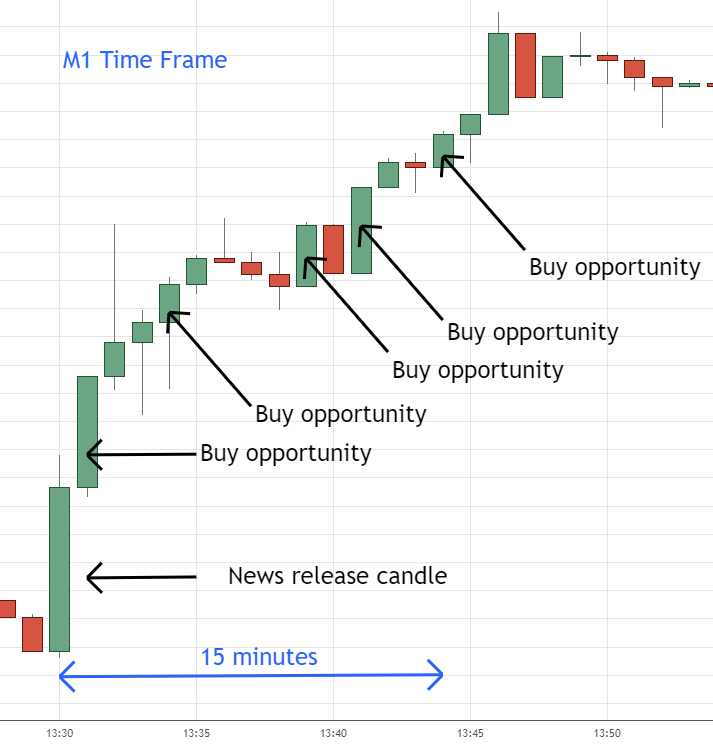

Do you know how many scalping opportunities may be there inside that 15-minute candle?

Just go to the 2-minute or even the 1-minute time frame, that’s 15 candles!

That’s a heaven of trading opportunities.

And the best part…

The market is trending…

Allowing you to catch some big moves with very small stop losses.

Trades that can be closed within a few seconds to a few minutes.

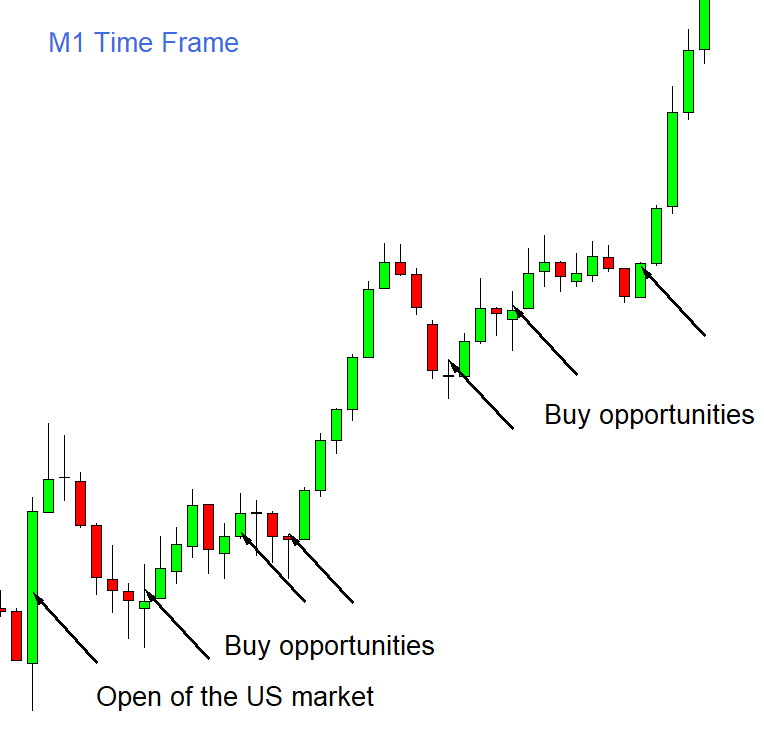

Open of the markets

This time is especially good for scalping stocks or indices.

The market behavior is quite similar to what happens when there are news releases.

Big candles…

Fast and big moves…

Clean setups…

Clear price action…

Look at this example.

How many trading opportunities could we get trading the first minutes after the open of the markets…

This is crazy!

And no one talks about this.

The best part?

You can quickly finish your trading day.

By scalping at the right time of the day, you can spend even less time trading than swing traders.

How crazy is that?

#3 You’re in control of your mental health

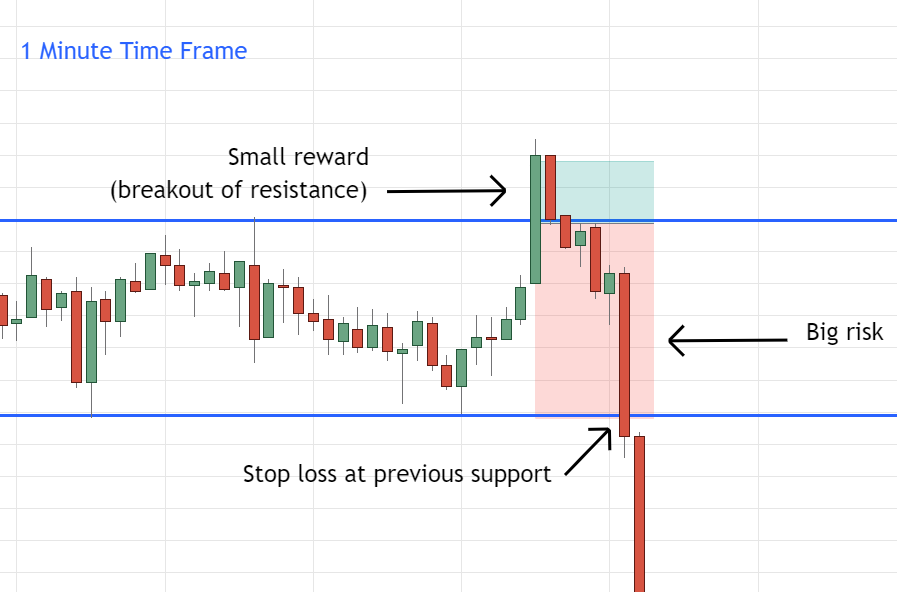

Imagine risking $500 to get $100 of profit.

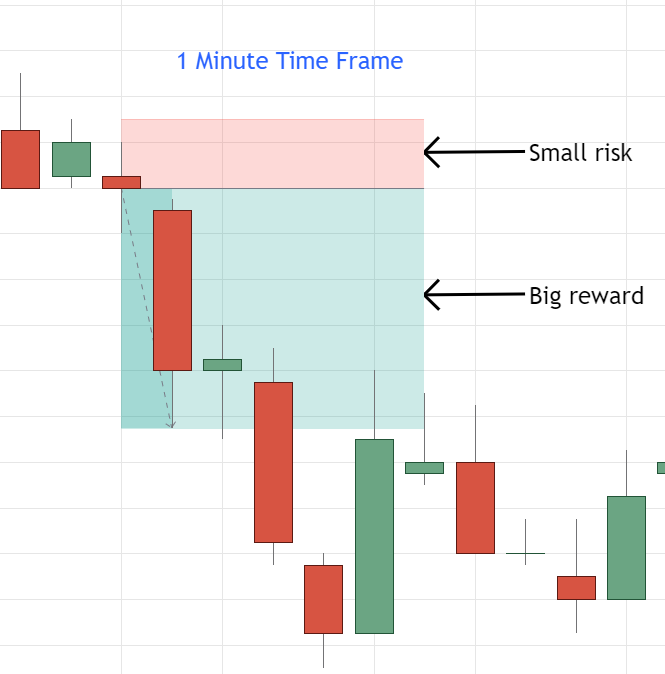

Taking trades like this one:

And now imagine risking $100 to get $500 of profit.

Which one do you prefer?

The second one, right?

And now you’re thinking…

“Oh, but to scalp, we can’t use very tight stop losses. A small move against my trade will stop me out unnecessarily.”

That’s far from the truth…

Look at this example:

Can you be profitable trading with high risks and small rewards?

Yes, you can…

But…

Will you be able to handle the pressure?

Taking a lot of trades…

Losing all the profits at once on a single loss…

Having to start your day from zero again…

Or even negative?

Sometimes after trading for hours?

That’s not a good feeling.

Mentally it’s exhausting and demotivates even the toughest warrior.

With that said, let’s do a quick recap.

Recap

- When scalping you’re focused like an eagle

- You choose the times of the day with higher volatility

- You control your emotions using proper risk/reward