In this post, you’ll learn why most traders fail at scalping.

Because…

If you know what are the mistakes that kill scalpers, you can get ahead of them.

Let’s start…

#1 You think that you are trading like a snipper (but you’re not)

Scalping is just getting a couple of pips or points on each trade.

And then repeat over and over until your day is done.

Right?

WRONG!

All the trading posts and videos that you watch teach you that scalping is trading like a snipper.

Well, in fact, it is…

But then they teach you how to take dozens of trades per day.

Since when did you see a snipper taking dozens of shots?

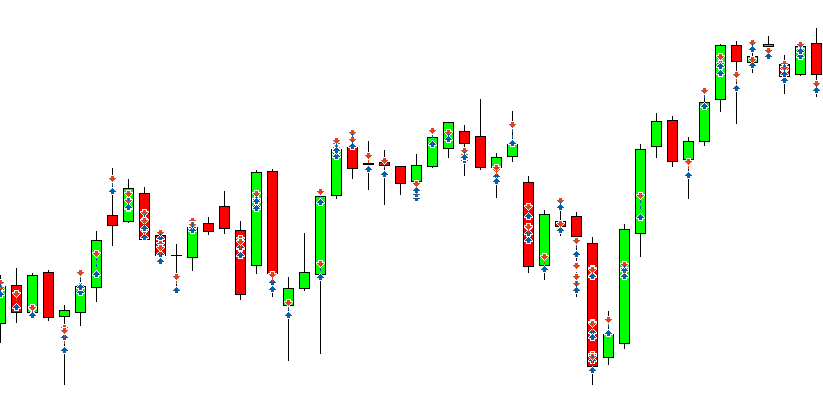

Do your charts look like this after a trading day?

That’s machine gun trading!

Where you fire everywhere and hope to hit something.

A snipper only has one, maybe two shots.

And whether he is successful or not, he quickly goes away.

#2 You try to hit your targets when they’re not there

As a snipper would you wait for your target while he’s sleeping at home?

Hoping that he wakes up during the night for some reason and gets out?

Or start shooting into his walls?

I guess not…

You’d probably wait for a time of the day when he’s getting out or arriving somewhere.

So, why do you scalp during the night?

When the markets are sleeping?

Barely moving…

Look at the difference:

I know what are you saying…

“Yeah, but when they are barely moving it’s easier to get a small move and get out…”

Well, not really…

You’re shooting to the walls.

You’ll never reach your target.

And that’s because…

#3 Your broker is a cannibal

During the night…

(and by that I mean, when the most important market sessions are closed)

The market spreads increase a lot.

So, if you trade Dax during the London session with a 1-point spread…

You can easily be trading with 10 points spread after hours.

Or if you trade EUR/USD with a 1 pip spread, you could be trading it with a 10 pip spread at night.

Have you ever noticed it?

These values are just indicative, they can be different from broker to broker.

But how do you expect to be able to scalp like that?

Those small moves that seem so yummy to get, don’t even take you out of the spread!

Look at this, how big should be the move to get you into profitable territory?

And do you think that this only happens during the “night”?

Think again…

Most brokers hate scalpers.

Even when the major market sessions are open.

Although their spreads may be smaller than at other times of the day.

They may still be big enough to make a difference to your survival as a scalper.

Trading with the right broker should be one of your first priorities.

#4 Your losses are bigger than an elephant’s ears

Imagine that you worked for a whole year to save to buy a new car.

And then when you finally get it…

You crash it in the first week.

How would you feel about that?

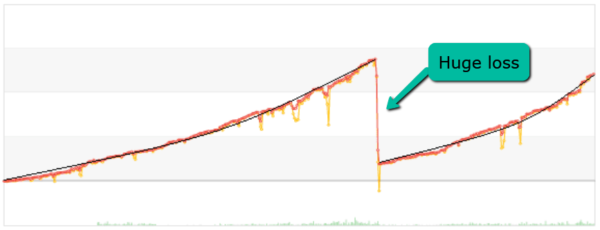

What about if you took 10 or 20 green trades in a day, and the last one wipes you out completely?

And even puts your day or week in deep red.

How would you feel if you got a hit like this after taking dozens of trades?

And what if you have two of them in a row?

Will your account be still alive?

The thing is…

It doesn’t matter if you have a 99% winning ratio…

If when you get that 1% red trade all your hard work disappears…

Recap

- Scalping like a snipper is very different than what you read and watch on social media.

- Scalping during the wrong times of the day will kill you.

- If you don’t have a broker with decent spreads you’ll be eaten alive, no matter how good are you at trading

- The risk/reward in scalping should be favorable to you.