When I started trading I learned how to draw supports and resistances.

I bet you did too.

“Look for a level where the price touched at least two times and bounced”, they say…

“Now draw a line there, that’s a resistance”, they say…

“Now wait for the price to get back up to that line”, they say…

“When it gets there you short”, they say…

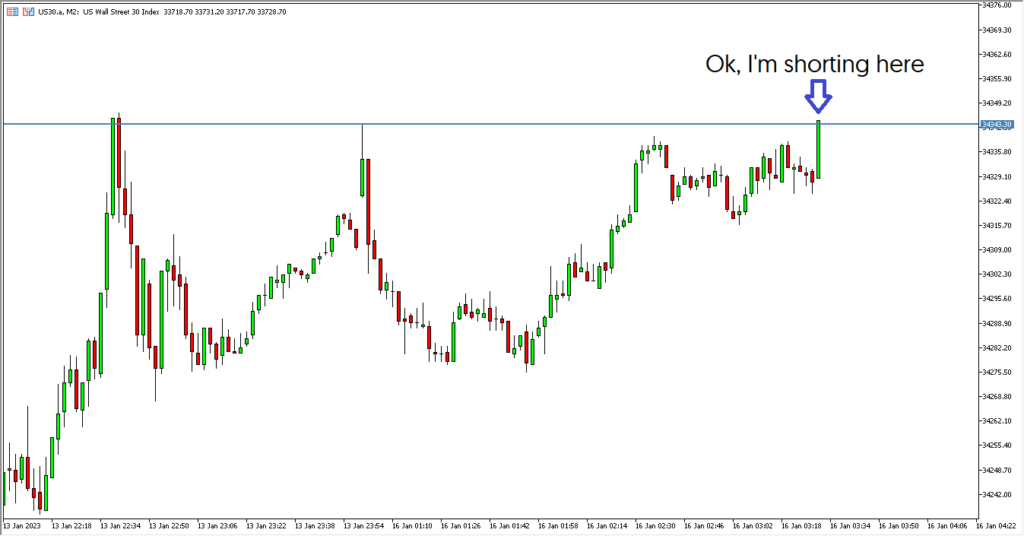

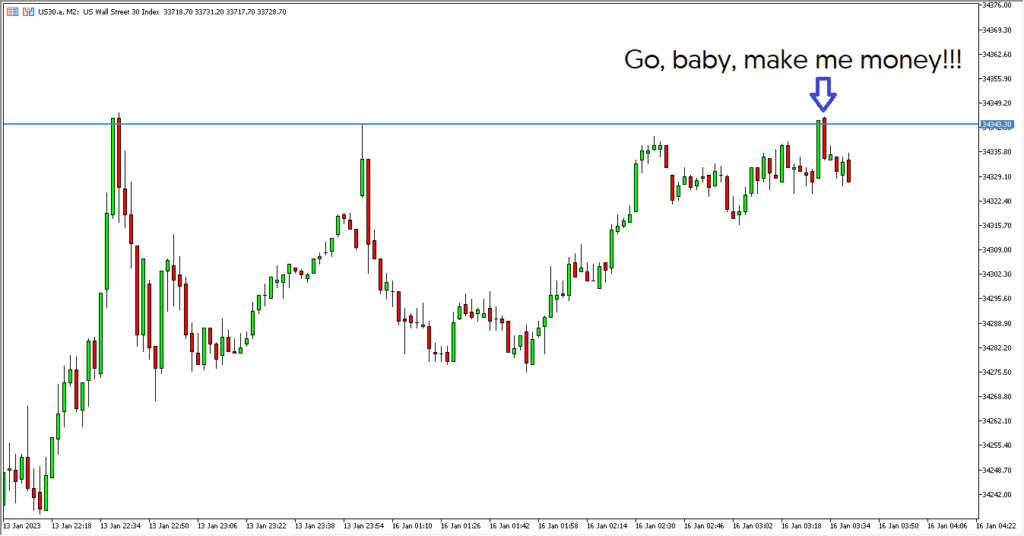

And you short…

Your heart starts pumping faster…

You’re completely glued to the charts…

The price starts moving down, in your favor…

“It’s looking good!”

And after a small move…

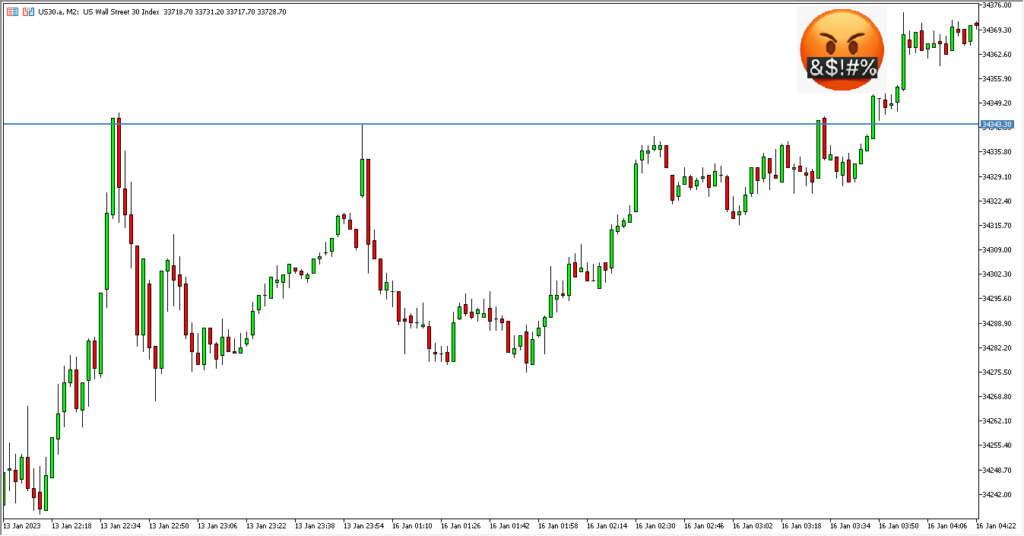

It comes back up again, stops you, and keeps going up.

You got wrecked once more.

Now you’re thinking…

“No Pedro, you also need to wait for a confirmation, some special candle pattern at the top.”

I agree that it sometimes works but in the long term…

The truth is that support and resistance levels don’t always work that way.

You need some secret sauces on your recipe to make them work better.

The more times a support/resistance is hit, the weaker it gets

“But Pedro, they always taught me that it gets stronger.”

Let me prove it to you.

It’s simple.

How often do you see support/resistance levels holding two touches?

A lot, right?

What about with three touches?

Less than the ones with two.

What about with four touches?

Even less…

Even if it holds, five, six, heck, even ten times, at some point it will end up breaking.

If it ends up breaking it’s because it got weaker.

Otherwise, all markets would move perpetually between the same support and resistance that would never break.

Because they would get so strong that it would be impossible to break.

Makes sense?

So, what do we need to do?

Identify the supports and resistances as earlier as possible.

One single peak at the right place may be enough.

(more about this later)

You wait for confirmations when you shouldn’t

Let’s say that you detect a beautiful support level.

And now you’re focused like an eagle.

Waiting for the price to touch it.

As soon as the price gets there you start salivating.

And you think…

“Now I just need to wait for a confirmation…”

“A candle rejecting the support and closing above…”

And as you wait…

You get horrified…

You see the price going up and up…

Closing waaaaay above your support level.

Look at this:

Are you going to go long there?

So far away from the support?

What about your stop loss?

Below the support?

Huge, huh?

And your target?

The last high?

You don’t even get a 1:1 risk-reward trade there.

You’re entering almost when you should be thinking about closing.

The thing is…

Confirmations may be good on certain occasions.

But not always.

In fact, in some scenarios, they will just hurt your trading performance.

“So Pedro, how do I know when it’s better to wait for confirmation?”

One key factor is how the price approaches your support/resistance.

(but more on this later)

Recap

- Supports and resistances get weaker at every new touch. The earlier you identify them, the higher your chances of success.

- Some supports/resistances work better when we don’t wait for a confirmation.

- The way the price approaches a support/resistance level is crucial to identify the need or not of confirmation.