So…

In my earlier posts, you’ve learned what is the reality of trading like a snipper, how scalping outside of the best times can kill your performance, and how your broker eats all your profits.

After that, we discussed focus, how your performance will tend to increase when you’re trading when you’re “not supposed to trade”, and how to keep your mental health stable while scalping.

In case you missed the lessons, here are the links:

Now:

Unlike what you’ve seen over the internet, trading forums, books, Youtube, blog posts, …, scalping is not what you think.

It’s much more than getting just a few ticks of profit and closing the trade…

And repeat dozens of times a day…

Instead, scalping is about grabbing a good amount of points in a few seconds or minutes.

Do it a couple of times a day using leverage, and stop trading with a potential decent amount of profit.

Free of pressure.

Free of urgency to recover from big losses.

Free to enjoy the rest of your day away from your charts.

Now, if you want to learn how you can do this and become a real scalper, then today’s lesson is for you.

You’ll discover:

- 1 – The SECRET to spot that a trend is about to start

- 2 – How to profit from trapped traders

- 3 – How to open trades with ridiculous small stop losses

Are you ready?

Then, let’s get started…

#1 The SECRET to spot that a trend is about to start

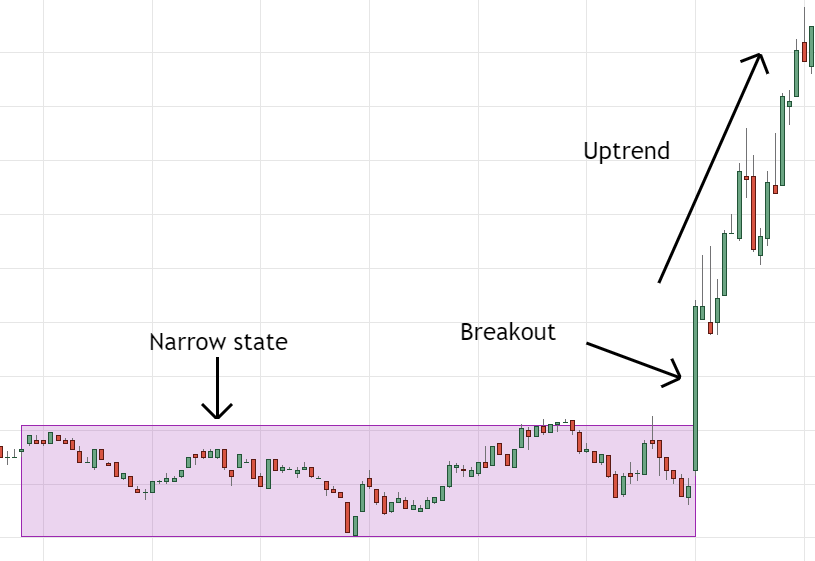

The best trends start from narrow states.

Now you’re probably wondering:

“What’s a narrow state?”

A narrow state is a consolidation of the price.

The big boys are quietly accumulating to their positions.

They don’t let the price move much.

And when they already have enough…

Booommm…

The price explodes.

Let me explain to you…

In a narrow state, the price makes small moves.

Usually between a support and a resistance.

All textbooks tell you to buy at supports and sell at resistances…

But…

You only know that there’s a resistance or support at some level after the price touched that level at least two times.

Beginner traders will think that the support and resistance get stronger the more times they are touched.

But an experienced trader…

He knows that the price is just getting closer to breaking that range, either to the upside or downside.

He just needs to wait for the right moment.

A breakout of a range tends to result in an explosion of the price, followed by a continuation.

Why the explosion?

Because all the range traders have their stop losses immediately above the resistance or below the support.

And when the price crosses that zone…

That whole cluster of stop losses is triggered…

And even more…

The breakout traders are there too.

With their pending orders waiting…

That’s a LOT of pressure that creates momentum going in the breakout direction.

Look at this example:

Do you see how solid was the close after the breakout of the range?

That’s when you can start thinking about buying.

The range was broken.

And now…

Just follow the trend and catch those big moves.

Next:

#2 How to profit from trapped traders

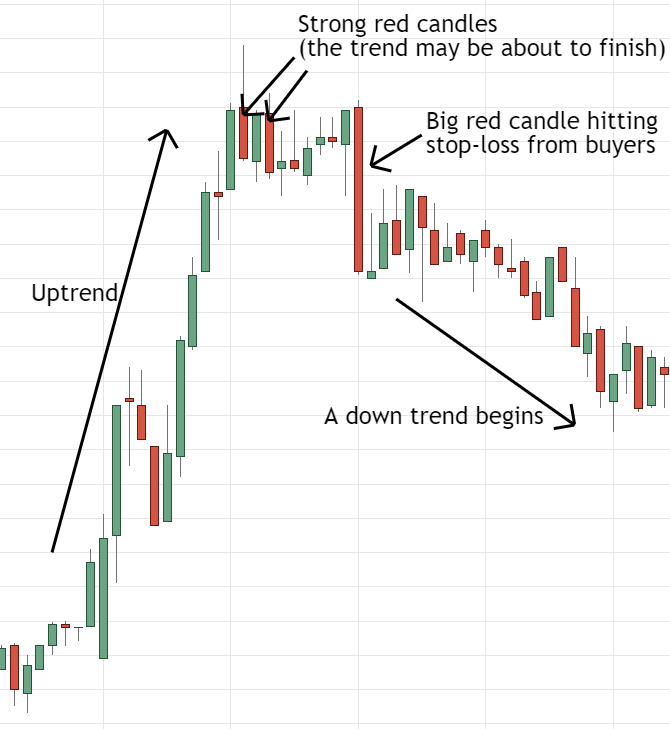

Trends are great to trade.

But they also finish at some point.

That’s when we should change our biases.

Now you’re asking:

“How do I know that a trend may be finishing?”

It’s much simpler than what you may think.

You know…

Trading is all about following the strength.

We already saw that trends tend to begin with a big solid candle breaking a range.

Trend traders will get into every pullback that they can to keep riding the trend.

But…

Not all pullbacks should be traded.

Which ones?

Those who are built with strong candles appearing against the trend.

Look at this example:

Beginner traders ignore the strength of the candles.

And they just enter again.

But most of the time…

They will end up getting stopped.

And that’s when experienced traders are looking for counter-trend trades.

Profiting from the beginner’s stop losses, which will add counter-trend pressure to the market.

#3 How to open trades with ridiculous small stop losses

We now know how to spot the trends starting.

As well as the potential end of the trend.

Now you’re asking:

“How do I trade those trends?”

That’s even simpler.

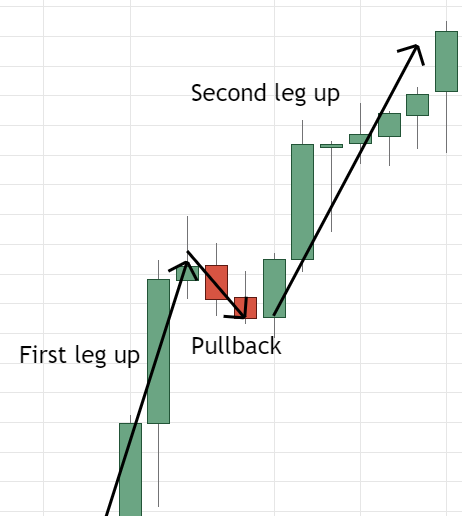

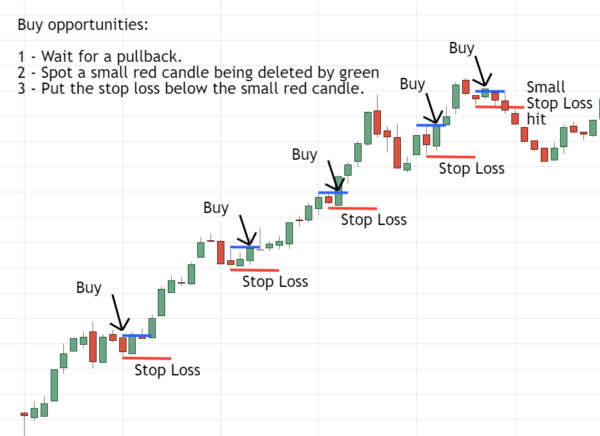

Step 1: Wait for a pullback

What’s a pullback?

It’s just a correction of the price.

On an uptrend, you wait to see the price coming back slowly after a leg to the upside.

This is how they look:

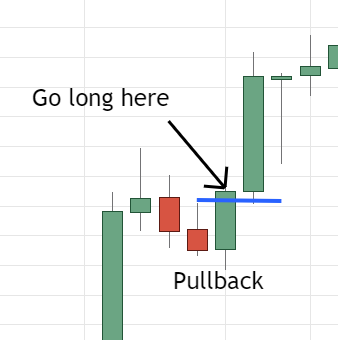

Step 2: Spot a small red candle being deleted by a green candle

You know…

Pullbacks on trending markets are short-lived.

The price tends to come back to the original trend quickly.

That’s what are we waiting for to open our positions.

But we don’t want to enter too late.

When the price is already breaking the previous high.

Instead, we want to enter the lowest possible.

To be able to ride the most out of the next leg to the upside.

So, what’s the right timing?

Wait for green to appear during a pullback.

When you see a green candle deleting a red candle.

That’s your entry.

Here’s an example:

Step 3: Place a small stop loss just under the deleted red candle

This is the key to having very small stop losses.

Why?

Because…

You are just risking one single candle!

This means that if you are stopped, it will be a very small stop.

But if you’re right…

Just let the price go…

Break to new highs…

And close after a decent move.

Look at the example below:

Lots of good long setups.

Big legs to the upside as expected on an uptrend.

Very small stop losses.

As you can see…

Any potential profit is much bigger than a stop loss triggered.

So, right now…

You’ve learned 3 powerful scalping hacks that work.

With this knowledge, you can better time your entries and exits.

You can also avoid getting yourself into trouble.

Of course, there’s much more to learn if you want to improve your trading performance.

Much more than I could put on a blog post or website page.

That’s why I’m opening the doors to my Flash Trading Program before I close the enrolment again.

It’s the perfect fit for you if you don’t want to rely on fundamental news, black-box algorithms, or even worse, trading signals…

So, if you want to join, just wait for my next email.