Today I’m going to show you all you need to know about Margin and Cash accounts.

In fact, both are very different.

Knowing which one to choose is crucial to avoid possible catastrophic results.

The decision that you are going to make depends a lot on your trading style.

Most brokers don’t give you detailed instructions on whether you need to choose a cash account vs a margin account.

This guide will help you to know the advantages and risks between margin and cash accounts.

And even more, it will help you to decide which one fits your needs the best.

Let’s start.

Margin accounts

What is a margin account?

Margin accounts are getting more popular over time.

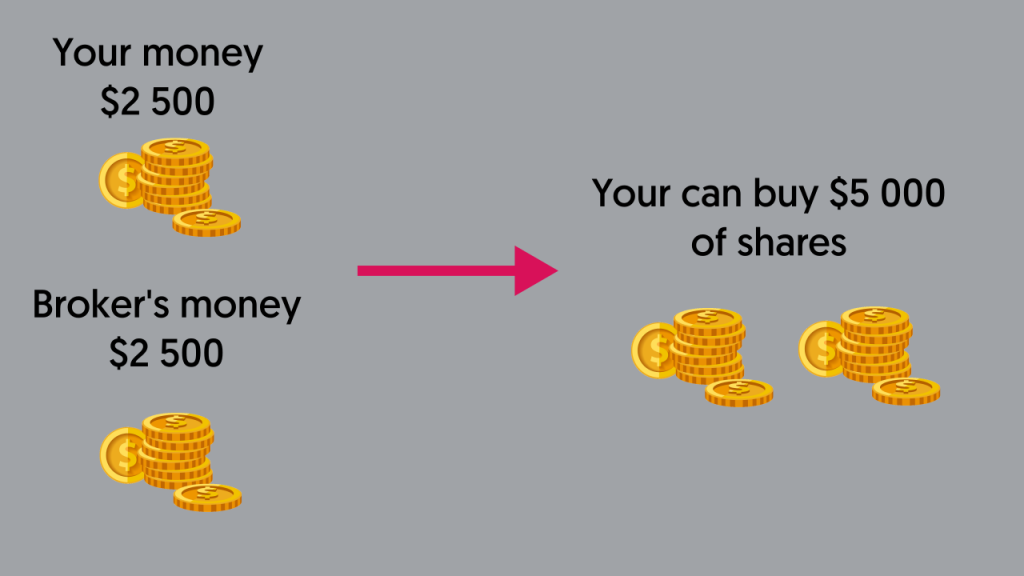

Their best benefit is that you can buy the same amount of stocks, with a smaller amount of money than what you would need if you paid them completely.

Basically, the broker borrows money to cover the remaining amount of your purchase.

Example:

- You want to buy 100 shares of #EBAY priced at $50

- If you needed to pay them completely you would need 100 x $50 = $5,000.

- If your broker borrows you 50% of the money, you only need to pay $2,500 for that same purchase.

- In both situations, you win or lose the same amount of money, either if the stock price goes up or down.

- When you sell your shares, you just need to return the money that your broker borrowed you, but the profits are all yours.

Using a margin account you can have the same returns, that you could get using a cash account, but using a smaller amount of money.

What is the minimum deposit for a margin account?

Typically the brokers will ask you to deposit at least $2,000 when you open a margin account.

That’s the minimum value that the New York Stock Exchange (NYSE) and the Financial Industry Regulatory Authority (FINRA).

This value can however be different depending on the broker that you are using and where it’s located, but $2,000 is the typical minimum deposit for a margin account.

What is the initial (or minimum) margin?

The initial margin is the minimum amount of money that you need to lock on your account to buy the shares that you want.

According to FINRA rules, brokers can lend you up to 50% of the amount of money that you need to make a transaction.

Example:

- You want to buy $5,000 worth of #BABA shares.

- Your broker can lend you up to 50% of that value.

- You only need to have on your account $2,500 to make the purchase.

Those $2,500 are the funds that you need to have on your account to buy that amount of shares.

Please note that the initial margin can be different depending on the broker that you use and their regulator.

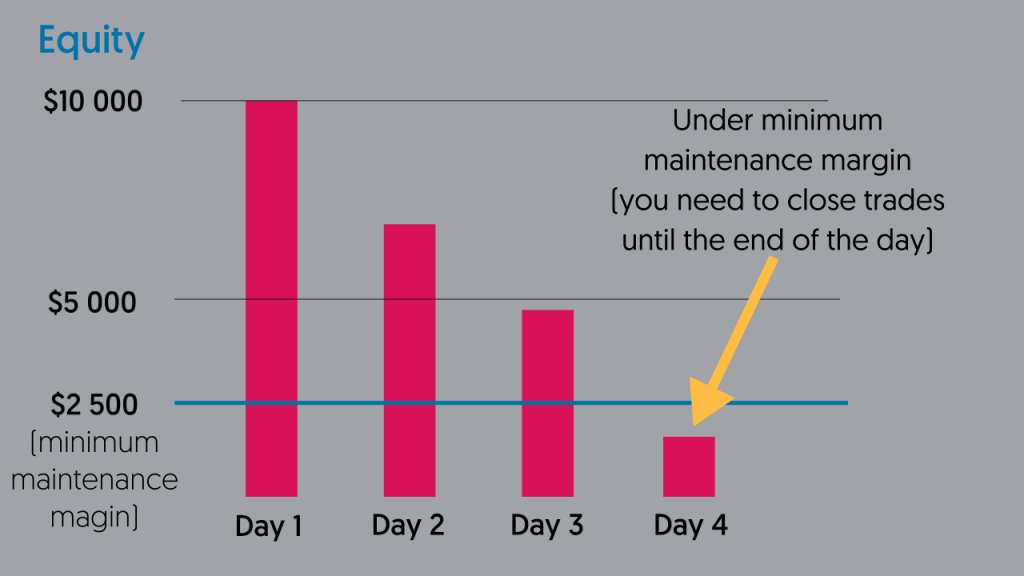

What is the maintenance margin?

The maintenance margin is the minimum amount of equity that you need to have on your account in order to keep your positions open.

According to FINRA regulations, the maintenance margin is set at 25% of your account.

What does that mean?

Simple, it means that your open positions can’t be giving you more than 75% of loss (of your total equity) at any given time.

Example:

- You have an account with $10,000.

- This means that your minimum maintenance margin is 25% x $10.000 = $2.500

- You decide to buy some #FB shares.

- If the #FB price goes down, your open position is giving you a loss.

- When that loss is so big that your equity is less than $2.500, you are not maintaining the required minimum margin.

- At this point, you may suffer a margin call.

Please note that the 25% may be different depending on your broker.

Some brokers may have minimum margins of 30%, 40%, or any other value.

Always check with your broker what is the minimum maintenance margin so that you can trade with safety.

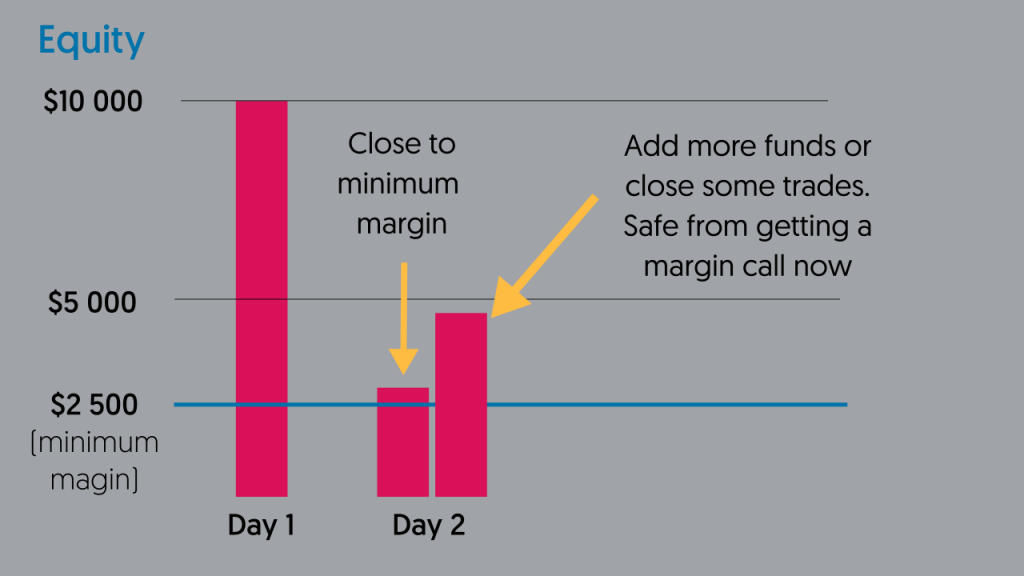

What is a margin call?

A margin call is an action that your broker can take on your trading account.

It happens when your available equity doesn’t meet the minimum maintenance margin required by your broker.

Let’s use the previous example.

Your account has $10,000.

At some point, your open positions may be in a loss that starts to get close to the minimum margin that you need to have on your account equity.

That would be $2,500 considering a minimum maintenance margin of 25%.

When your equity starts to get close to that $2,500 you start to get warnings from your broker.

At this point you have two things that you can do:

- Close some of your losing positions

- Add more funds to your account.

And what if you don’t do anything?

Well, if your equity keeps dropping and meets the $2.500 value your broker can start to close your positions.

Usually, it starts with the one that is giving you the bigger losses.

If your losses keep increasing it will keep closing other positions that you may have open.

And why do margin calls exist?

That’s a mechanism to prevent a trader or even a broker from suffering big losses.

Markets sometimes can make huge spikes.

During this short periods it may be difficult to close trades at a determined price. This means that your trades can close with bigger losses than the loss that you had when you hit your close button.

If your available margin is very small, your account can go into a negative balance!

The same may happen during gaps, either daily or weekly gaps.

If they are big, and the price went against you, your account may go into negative balance as well.

And nobody wants that, right?

The danger of margin accounts.

Margin accounts can be very attractive for traders, since they can deliver higher returns, in a smaller amount of time, when compared to cash accounts.

However, this comes with some risks and dangers.

The main risk is that you can lose a substantial amount of your capital in a short period of time. The potential higher returns are associated with potentially bigger losses.

But this can get worse.

You can even lose more money than what you have deposited in your account.

How?

You are using money that you borrowed from your broker.

The broker will tend to close your trades if the money that you are losing on open trades gets very close to the amount that you have deposited on your account.

But this is not always possible.

The market can make sudden big moves, and your broker is not able to close your trades before the loss exceeds the amount of capital that you have on your account.

And another common danger.

The stock market also has frequent gaps.

If you are holding a trade for another day, and the market opens with a big gap against you on the next day, your trade will instantly go into a big loss.

Your broker will immediately close your trade, but that loss can be bigger than the amount of money that you have deposited on your broker.

In both situations, you will have to pay the broker the extra money that you lost and didn’t have deposited on your trading account.

Always be careful when you are trading margin accounts as high risks are also associated.

The benefits of margin accounts.

The first main benefit of margin accounts is that you can leverage your money deposited on the broker.

Meaning that, you can get higher returns.

You can trade more stocks at the same time with the same amount of money.

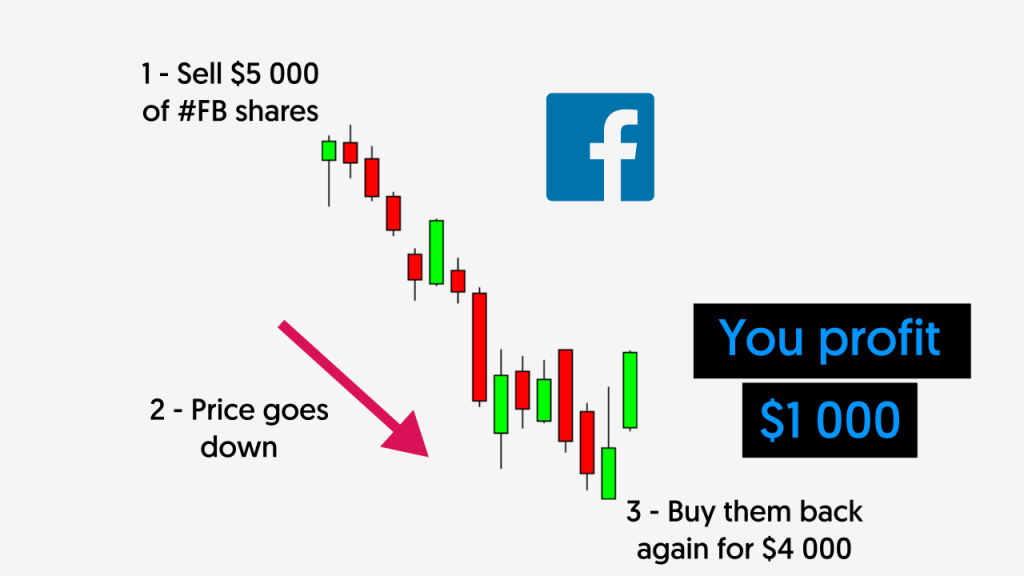

Besides that you have the ability to short-selling.

If you believe that some stock price will go down you can profit from that drop.

The broker lends you stocks to sell and you can buy them back at lower prices.

After you close the transaction, the stocks that you bought are given back to the broker.

The profit from the transaction is all yours.

Example:

- You sell $5,000 worth of #FB stocks.

- The price goes down and at some point, those stocks are valued at $4,000.

- You buy them back at that price, and you get a $1,000 profit from the transaction.

Disadvantages of a margin account.

1 – Paying interest/fees over time.

You have a higher buying power using a margin account.

Meaning that you can use more funds to buy stocks, besides the funds that you have deposited on your trading account.

Since your broker is borrowing funds to enable you to make the purchase, you’ll have to pay interest and fees for that money.

It’s similar to a bank, when you have a bank loan, you pay interest on that amount of money until the loan is paid off.

For this reason, if you plan to hold your stocks for the long term, you should ask yourself if the interests that you’ll pay are worth the return that you expect to have.

2 – Margin calls

Your broker will only allow that you have open trades while you have enough cash to cover eventual losses if the price goes against you.

If your equity goes under a certain amount of money, the broker has the right to close your trades.

Can I change a margin account to a cash account?

Yes, it’s possible but it depends on the type of accounts that your broker provides.

1 – Your broker provides both margin and cash accounts

In this case, you shouldn’t have any problem.

You can start by contacting your broker telling them that you want to change from a margin to a cash account.

In most cases, the solution will pass through creating a new account, a cash account.

Then you just need to transfer your funds from the margin account to the cash account and you’re done.

2 – Your broker only provides margin accounts

In this case, there’s not much that your broker can do to help you.

The only solution is to open an account with a broker that provides cash accounts.

After this, you either deposit fresh funds on your new cash account or withdrawal from your initial broker and deposit on your new broker.

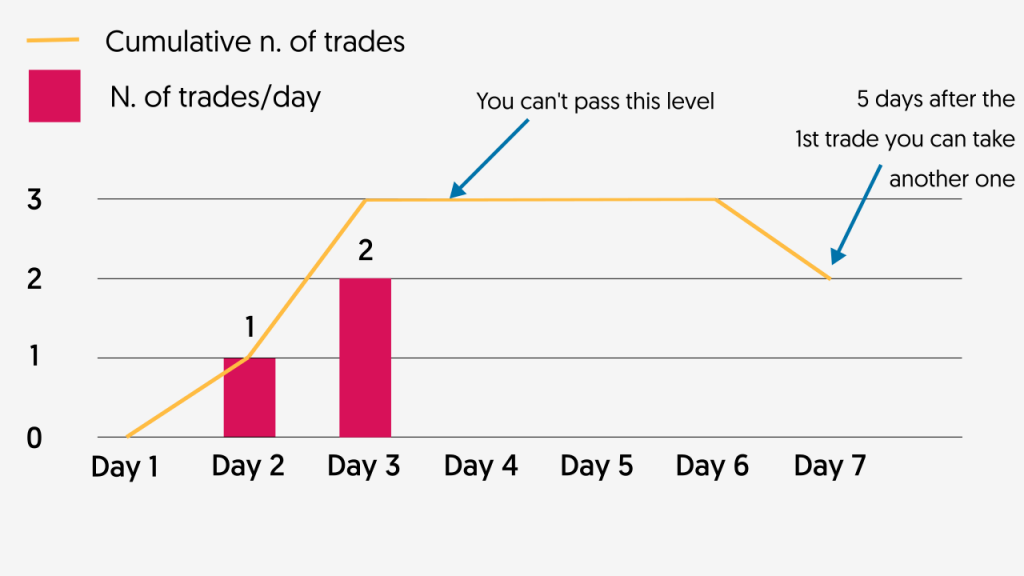

What is the PDT rule?

PDT stands for Pattern Day Trader.

A Pattern Day Trader is a trader that executes 4 or more day trades within 5 working days using a margin account.

A day trade is a trade that is open and closed within the same day.

If you do or plan to do such an amount of trades, you’ll be flagged as a Pattern Day Trader.

This rule aims to prevent excessive trading that can lead to catastrophic results.

That’s especially true for beginners that are still learning how to trade stocks.

How can you avoid PDT?

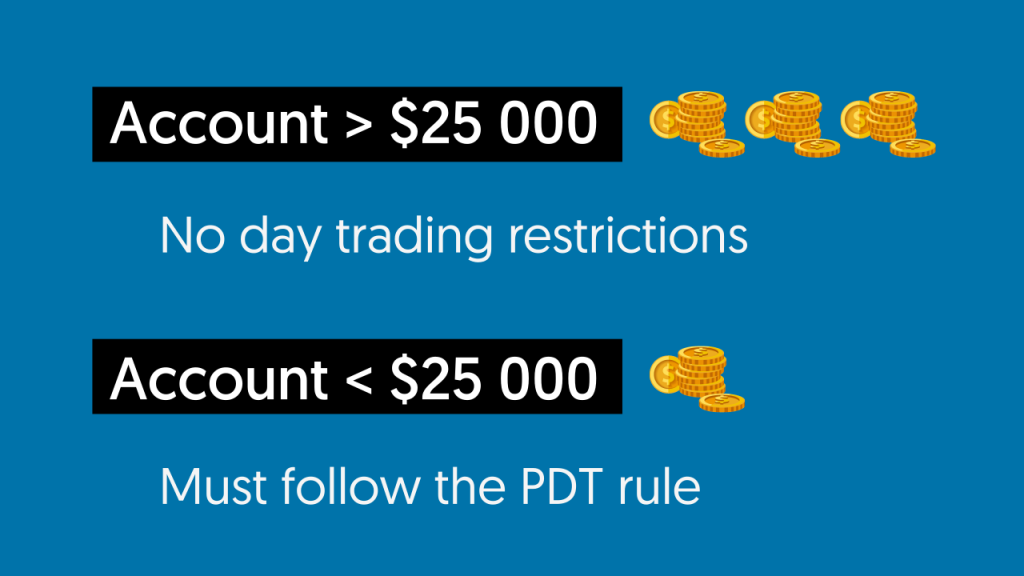

If you are a day trader, you probably don’t want to be restricted by this PDT rule, right?

The solution is simple.

The Financial Industry Regulatory Authority (FINRA) is very clear about this.

To be able to avoid the PDT rule, you must hold in your account a minimum of $25,000.

That amount can be cash but also other securities.

As long as your equity is above the minimum of $25,000 you can day trade as much as you want.

But be careful.

If your equity falls under that value, the PDT rule will start to apply to you immediately.

If that happens, stop day trading until you recover to the minimum equity.

Otherwise, you may be subject to sanctions and your trading account may be restricted.

And nobody wants that, right?

Also never forget, that different brokers may have different rules.

Always ask your broker about the rules that you should follow.

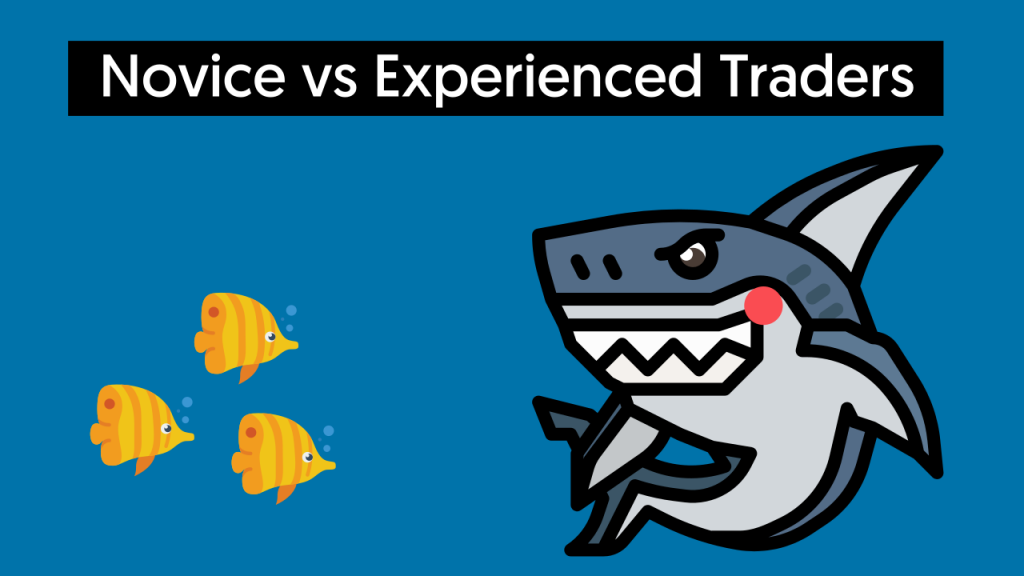

Why do you need 25K to day trade?

Most of the day traders start as novices.

They have no idea how to trade, they just want to make quick money.

But well, they are competing with the most brilliant minds in the world that are already trading for years and years.

The result: they end up losing all their money very quickly.

By being required to have a minimum amount of $25,000 to trade, this kind of casualties is less.

And they are already very big…

The minimum amount of $25k is meant to protect you.

The SEC uses the account size to evaluate how experienced you are as a trader. If someone has less than $25k to trade, is more likely that they have small experience.

The less experienced you are, the more likely is that you do dumb things.

Novices trade aggressively against professional traders and that usually results in the novice having significant losses.

Who should open a margin account?

Margin accounts have a lot of flexibility.

They are most used by active traders.

If your trading strategy requires you to open and close several trades on the same day, a margin account is the one that you should use.

If you plan to sell your stocks in the near future, margin accounts can also be the best option for you.

You always get your cash immediately available as soon as you sell shares that you own.

This allows you to quickly reinvest your funds if you pretend to buy stocks from a different company.

Cash Accounts

What is a cash account?

A cash account requires that all transactions are made with the available cash in your balance.

As opposed to the margin accounts, you are not allowed to borrow money from your broker to trade.

A quick example:

You want to buy 10 #AAPL shares.

Let’s say that the current #AAPL price is $300.

How much money do you need to have on your account to purchase them?

It’s simple: 10 shares x $300 = $3,000.

It’s the exact same concept of a common market transaction, either if it’s on financial markets or any other type of market.

The math is the same as going to buy bread in your bakery.

Who should choose cash accounts to trade:

- Conservative traders who don’t want to be exposed to high market risks, like daily price changes.

- Long term traders who aim to get profit only after some weeks, months, or even years.

- Traders that want to hold the shares forever! Getting benefits from potential dividends distributed by the company.

And you know what, it’s a good way to leave some good, if not amazing wealth for your family.

If you have a conservative trading approach and don’t want to be exposed to higher risks, that’s the kind of account that you want to choose.

What are the benefits of a cash account?

1 – No margin calls

You are using your own funds to purchase stocks.

Not using money borrowed by your broker.

For this reason, you don’t have a margin call.

Your trades PnL can go as low as you want.

2 – No overnight fees

Again, you are using your own money.

You don’t have to pay any interest/fees to your broker and can hold your trades as long as you want without spending any money on interest.

3 – You can’t lose more money than what you have invested.

Your stock’s price can go as low as 0 on an ultimate scenario.

The only loss that you can have is the amount of capital that you invested.

What are the disadvantages of trading a cash account?

1 – Smaller buying power

You can’t leverage your returns by borrowing funds from your broker.

Meaning that you can’t buy the same amount of stocks that you potentially could if you had leverage.

Your returns will come exclusively from your own amount of capital.

2 – You are not allowed to day trade

When you trade with a cash account your transactions will not be executed immediately.

There’s a thing, called settlement time, which is the time that passes since you buy or sell the stocks, to the moment that you actually get the stocks or your money back.

3 – You are not allowed to short trade

Short trading implies that you borrow stocks from your broker.

The broker needs to make sure that you are going to give the stocks back to them in the future.

When you use a margin account, the brokers lock a certain amount of money on your account to protect themselves.

Since you are not using margin, your broker can’t lock this specific amount of money to recover the loan in the case that things go bad for you.

Due to that, you are not allowed to borrow stocks from them to short sell.

Settlement Time

This settlement time is something super important if you trade using a cash account.

When you fail and violate the settlement time rules, you’ll get penalties on your trading account.

And you don’t what that, right?

Let’s learn all you need to know to avoid those penalties and trade with safety.

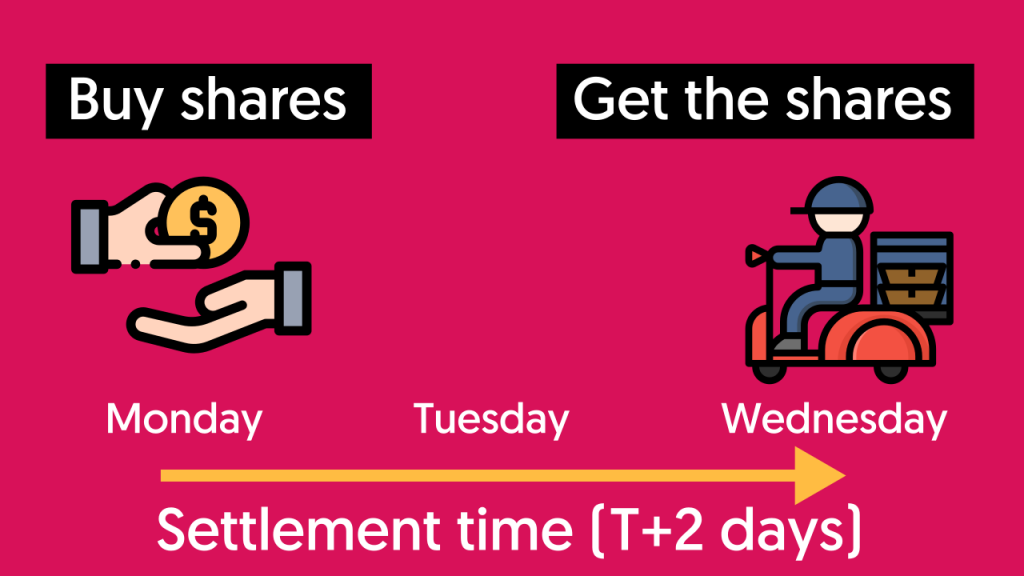

What is the settlement time?

When you purchase shares using a cash account, you probably won’t get the shares immediately.

This is called the settlement time.

This time is often shown as:

- T+2

- T+3

- T+5

So what do this T+x mean exactly?

The 2, 3 or 5, are simply the days that it takes for the transaction to settle.

The number of days that you need to wait before you get the shares.

During this settlement time, the buyer must have paid for the stocks. On the other side of the transaction, the seller must have delivered the stocks too.

How long does it take for a stock trade to settle?

Back in the days, T+5 was the number of days (5) that a stock transaction would take to be settled.

Well, this could take weeks in the 1700s, as the money and shares would need to travel a long distance through a courier to make the journey on horseback and by ship.

As technology advanced, the settlement time decreased.

In 1993, it decreased to T+3 (3 days to settle).

Since 2017 it decreased even more. Now, stock transactions are settled 2 days after the transaction date. That’s T+2.

Let’s say that you buy #TSLA stocks on a Monday. You’ll only get your stocks on Wednesday since the settlement time is 2 days.

Also don’t forget about one important thing:

The number of days doesn’t include weekends or holidays, so it may take a few more days, depending on the day of the week that you are triggering the transaction.

Why does a stock trade take time to settle?

Back in the days, when you purchased a stock, you would need to wait and get a physical stocks certificate.

With the Internet, things got quicker, and you don’t have to wait such a big amount of time until you own the stocks.

If all the brokers collected money and stocks upfront, it would be possible to have the same-day settlement.

On the other hand, there are hundreds of small to mid-sized brokerage firms who still collect cheques and other slow payment methods.

Until they are all online, it will not be possible to have instant transactions with a cash account.

The stockbroker gets time till the morning of T+2 to deposit the entire purchase amount of money with the exchange.

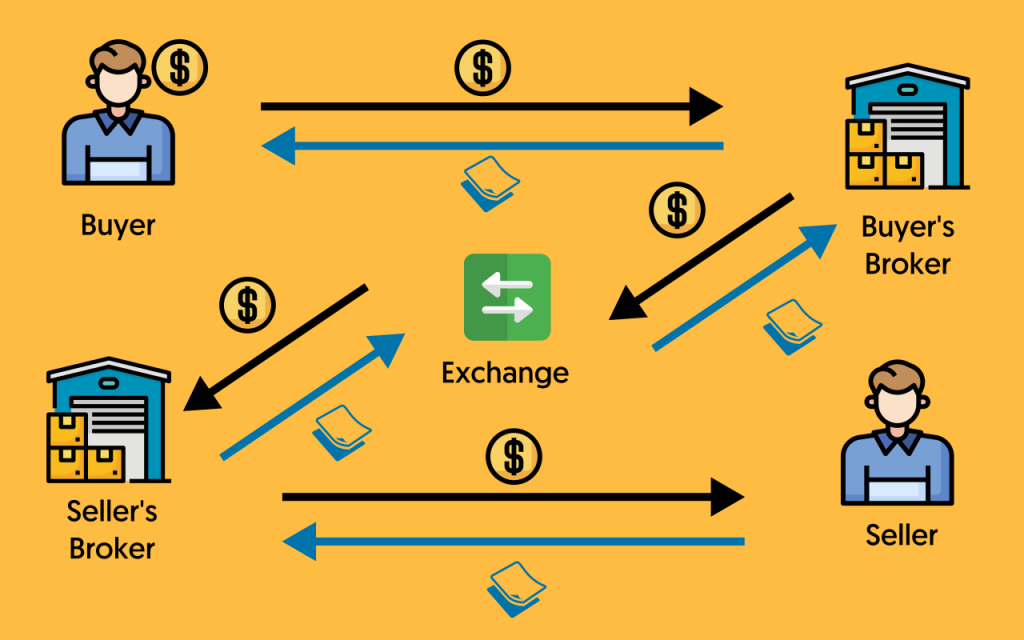

So, this is the process:

- A buyer triggers a buy order through his broker.

- The broker sends the order to the exchange.

- The broker has T+2 days to send the money to the exchange.

- The exchange receives the shares from the selling broker.

- The shares are sent to the buying broker.

- The buying broker credits the shares to the buyer.

As you can imagine, this entire process can easily take two days.

The tendency for the future will obviously be to decrease this time to 1 day, same-day, or even instant transactions.

Can you trade with unsettled funds?

When you sell a stock, you get the funds from the stock transaction immediately.

But those funds are still unsettled until the settlement time is over.

Why?

Well, just because your broker didn’t receive the funds from the buyer’s broker yet.

You can use those unsettled funds to make a purchase.

But there’s a catch.

You must follow a good faith rule.

You need to hold your stocks until your funds settle, or until you make a new deposit that is enough to pay for those stocks.

Example:

- You sell #FB stocks on a Tuesday

- Your funds will only settle on Thursday (T+2 days)

- You use those funds to buy #NVDA stocks on Wednesday

- You must hold the #NVDA stocks until your funds settle on Thursday

When the funds that you use to make the purchase are already settled, you don’t have any restrictions. You can sell those stocks at any time.

Settlement rules violations

Although trading with unsettled funds is allowed, you must be careful not to violate the rules that apply to those kinds of transactions.

There are three types of violations that you may incur and give you a sanction:

Good faith violation:

This occurs when you sell a stock and are waiting for the funds to settle.

You know that you can use those funds to buy other stocks.

On the other hand, if you sell those new stocks before the funds from the first transaction settle, you’ll incur a good faith violation.

Freeride violation:

You can buy stocks in a cash account and have insufficient funds at that time.

But you need to deposit them before the settlement time is over.

If you sell those stocks, before you pay in full for the whole transaction, you’ll incur in a freeride violation.

Cash Liquidation violation:

This kind of violation occurs when you don’t have enough funds to cover the cost of a trade when the settlement date arrives.

Example:

- You own $5,000 of #MSFT stocks and you have $2000 of balance on your account.

- On day 1, you purchase $4,000 of #AAPL stocks.

- Since you only have $2,000 of balance you need to cover the remaining $2,000 of the purchase amount in two days before the settlement time is over. This will be on day 3.

- On day 2 you decide to sell your #MSFT stocks for $5,000. That will be enough to cover the remaining $2,000 that you still owe to your broker.

- The $5,000 funds from your sale will only be settled two days after the purchase. That will be on day 4.

- When you reach day 3, you still don’t have enough settled funds to cover the #AAPL transaction that you made on day 1.

When this happens, you incur on a cash liquidation violation.

What sanctions can you get for violating settlement rules?

When you violate a settlement rule, your account will be restricted.

You’ll be penalized with a 90-day restriction.

Although you are allowed to use unsettled funds for stock transactions, you should be aware of the rules in order to avoid any penalty and restriction to your account.

Trading with a margin account can help you to avoid these kinds of violations since they are only applied to cash accounts.

Should I open a margin account or a cash account?

It all depends on your trading style and the risks that you are willing to take.

If you plan to trade only for the long term, cash accounts are definitely the best choice for you.

If instead, you plan to day trade frequently, a margin account is probably the best choice. But always be aware of all the dangers that an account of this type brings and trade wisely.

What about you?

What type of account do you use to trade?