Almost everyone that starts to trade usually jumps into trading forex markets.

Since it’s the most traded market in the world, we are constantly being bombarded by forex advertisements.

But should you really trade forex instead of stocks or indices?

The market that you choose to trade, may have a high impact on your profitability.

Throughout this article, we’ll see what are the pros and cons of trading each market regarding different market characteristics.

Before we go into them, keep in mind that you may find that there’s a better market for you to trade.

Let’s get started…

1 – Volatility

Day traders and short-term traders need a lot of volatility in order to profit.

Fast moves in price during the day are important to be able to make a profit quickly.

That’s why day traders usually choose forex to trade.

But you know what, forex has low volatility.

In fact, regarding volatility, trading forex is less dangerous than trading stocks or indices.

Let’s analyze that in detail.

Volatility in Forex

Check this graph with the volatility of the most traded forex pair, EURUSD.

The average daily volatility in the last 12 months is 0.24.

And this one is from GBP/USD.

It’s more than EUR/USD, 0.38, but still, not very much.

And now look at GBP/JPY, one of the most volatile forex pairs.

The average daily volatility for the past year was higher than EUR/USD and GBP/USD, but still, no more than 0.41.

Volatility in Indices

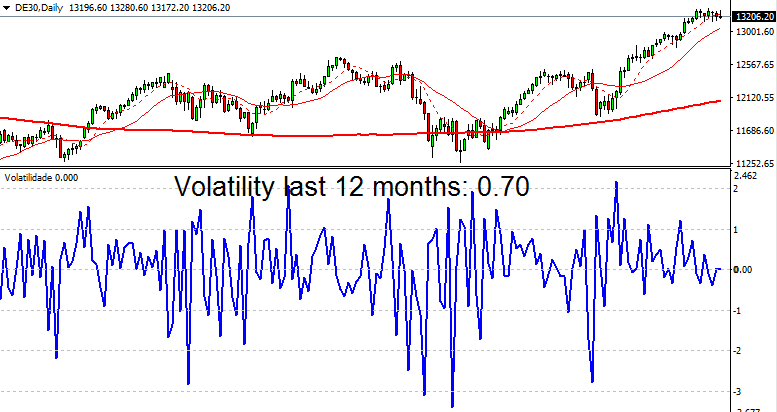

Now take a look at DAX’s volatility.

DAX’s average volatility is 0.70.

Roughly the double of the forex currency pairs volatility that you just saw.

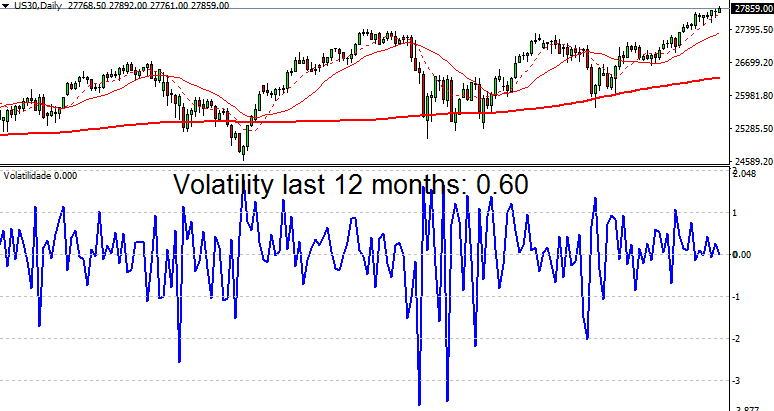

And look at Dow Jones.

Although it’s a little less than DAX, the Dow Jones index also has volatility higher than forex, 0.60.

Volatility in Stocks

Let’s look at #AAPL (Apple), one of the most popular stocks to trade.

The volatility in #AAPL is 1.21.

That’s the double of DAX or Dow Jones!

Another example is #FB (Facebook).

The volatility is 1.29, similar to AAPL volatility as expected.

Which has higher volatility: forex, indices, or stocks?

After analyzing the past examples, there’s no doubt that stocks have the highest volatility.

That makes them great for day trading or scalping.

Forex is what has the lowest volatility, so it’s the worse one to trade, especially short-term.

Indices are in the middle, between forex and stocks. They are an excellent option for day trading.

Keep in mind that you need volatility to trade. It creates steady long trends with clear entry signals.

Is forex dangerous because of the volatility?

No way!

Forex has less volatility than Indices or Stocks.

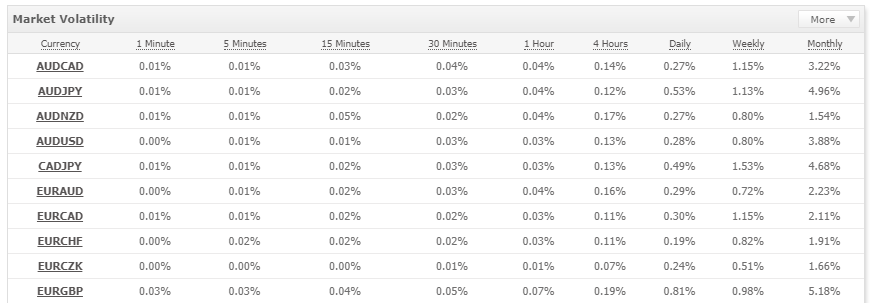

Forex volatility: 0.24 – 0.41

Indices volatility: 0.60 – 0.70

Stocks volatility: 1.21 – 1.29

You can get more info about other pair’s volatility in myfxbook:

Forex is only dangerous because of the big leverage that is provided by the brokers.

That’s what kills most people’s accounts that try to trade forex.

They don’t know how to use the leverage and they just burn their accounts.

If there was no leverage in trading, Forex would be the safest option to trade.

So, let’s see what is leverage and margin.

2 – Leverage and Margin

Leverage and margin are inversely correlated.

This means that when the leverage increases, the required margin decreases, and vice-versa.

What is the required margin in forex?

The required margin is the amount of money that your broker locks on your trading account each time you open a trade.

The higher the lot size that you are trading, the higher will be the required margin.

After you open trades, if they go into negative beyond the required margin, your broker may close some or all of your positions. That’s called a margin call.

The inverse of the required margin is leverage.

What is leverage in forex?

Leverage is a way to measure the amount of money that your broker “lends” you to trade.

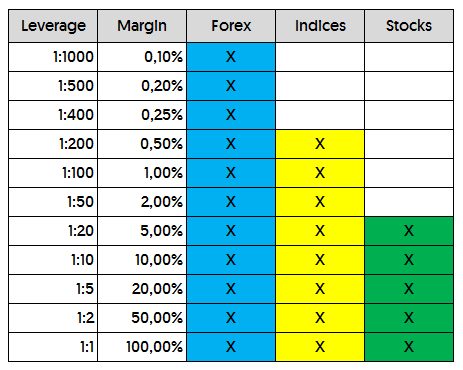

Forex has the highest possible leverage.

It can go as high as 1:1000.

This means that you can buy $1000 of a forex currency for just $1.

That’s crazy!

Next, we have Indices. They are usually traded with leverage up to 1:200.

And to finish we have stocks. The leverage provided is usually capped at 1:20.

The less leverage the broker provides, the more amount of money you need to have in your trading account.

Here is a table with the required margin and leverage usually provided for trading forex, indices, and stocks:

Depending on which part of the world you are in, you may even have more restrictions regarding leverage and required margins.

In the EU, due to recent measures implemented by ESMA, the European Regulator, the leverage available in European countries was drastically reduced.

What are the new leverage limits imposed by ESMA?

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold, and major indices

- 10:1 for commodities other than gold and non-major equity indices

- 5:1 for individual equities

- 2:1 for Cryptocurrencies

The US regulations, set by regulators like NFA, SEC, or FINRA, also restrict the maximum provided leverage for trading, including forex:

- 50:1 for major currency pairs

- 20:1 for non-major currency pairs

How much leverage should I use?

The way to restrict the leverage that you use is by trading with less risk, using smaller lot sizes or less contracts.

If you are not a profitable trader, it’s good that you always trade the smallest possible lot size.

When you gain consistency trading, then you may start to increase your lot size.

But do it slowly.

Increasing just a small amount each time.

And keep your account safe by avoiding using a high lot size.

If you follow these lines about what lot size you should use, you’ll be fine.

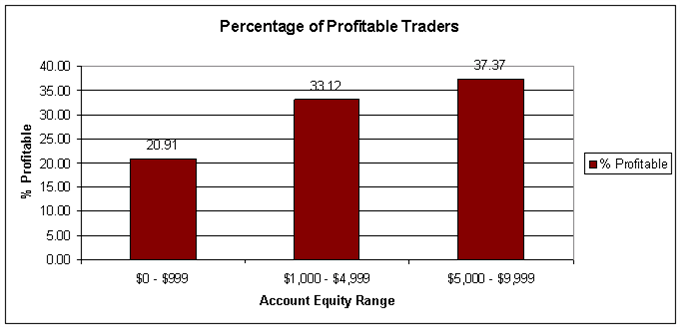

Studies show that when you trade with a larger account, you tend to have an increase in profitability.

It’s believed that it’s due to the leverage used on the trading account.

Conclusion about forex, stocks, and indices leverage?

The less leverage you use, meaning lower lot sizes, the safer you will be trading.

Forex has the higher leverage provided, meaning that you need a smaller account to trade. It’s a good option if you have limited resources.

Stocks require the most amount of margin to trade, so you need a bigger account to trade stocks. This is especially true for day trading.

Indices are between forex and stocks. They have usually a good compromise between available leverage and account size.

3 – Liquidity

What is liquidity in forex?

Liquidity measures the ability of a forex currency pair to maintain the exchange rate when is traded. The higher the liquidity, the more difficult is for the price to move.

The same concept applies to stocks and indices trading.

How does liquidity affect the trading price?

You can think of it as a barrier. When you click the buy button on your trading platform, you are actually buying from someone that is selling at that moment. If the amount that you are buying is higher than what is available to sell, the remaining amount will be bought at the next available price. That’s what makes the market price move.

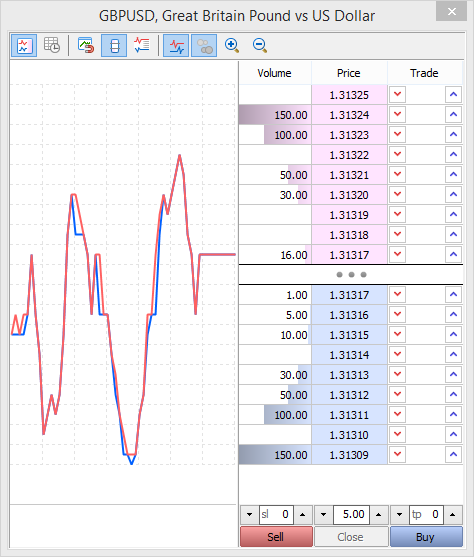

Check this example, with the volume of pending orders at different prices in GBP/USD.

On the top, we have the sell pending orders.

On the bottom, we have the buy pending orders.

You can see that if you buy GBP/USD now, you’ll buy it at 1.31317, which is the better selling price at this moment.

You can also see that the amount available to buy at that price is 16.

This means that if you buy an amount bigger than 16, let’s say 20, the remaining 4 will be bought at the next available price. The next available price is 1.31320, with an amount of 30 available.

You end up with 16 bought at 1.31317 and 4 bought at 1.31320.

When you buy an amount lower than 16, the price will not move. The liquidity is enough to absorb your order.

But when you buy an amount higher than 16, the 1.31317 level will drain and the price will move to the next level, at 1.31320.

You actually made the market price move!

And that also caused the spread to increase.

The spread is the distance between the buy and sell pending orders.

Since that distance increased, the spread is now bigger.

A big advantage of liquid markets is that the spread is usually lower than in markets with less liquidity. Because it’s more difficult to drain a level and also, when that happens, there are a big amount of orders on the next levels, without a big distance between them. And that also helps with the slippage.

What is slippage in trading?

Slippage is the distance between the price where you set your order to open (or close) and the price where that actually occurs. This is more likely to happen when you trade markets that are not very popular or when you trade during high volatility moments.

Does liquidity affect slippage?

Yes, it does, in fact, slippage is caused by the lack of liquidity.

When the price hits your stop loss, the broker will try to close it at that price.

If there are no matching orders at that price, meaning, no one is interested in “buying what you are selling” at that price, then your order close will jump to the next price with matching orders.

What are the best markets to trade regarding liquidity?

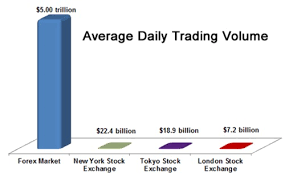

Forex has by far the highest liquidity to trade. That’s also why the volatility is low. It’s not easy to make the price move.

Just look at the average daily trading volume in forex, compared to stocks.

The difference is huge.

But you shouldn’t be afraid of trading stocks because of the liquidity unless you are trading cheap penny stocks. Or unless you are trading a huge fund with billions in your account.

If you are trading quality stocks, the liquidity is more than enough for you to trade comfortably. Just look for the best stocks to buy.

The same applies to indices. If you want to trade DAX, Dow Jones, or any other popular index, the liquidity provider from your broker will have no problem handling your trade volumes.

4 – Trading hours

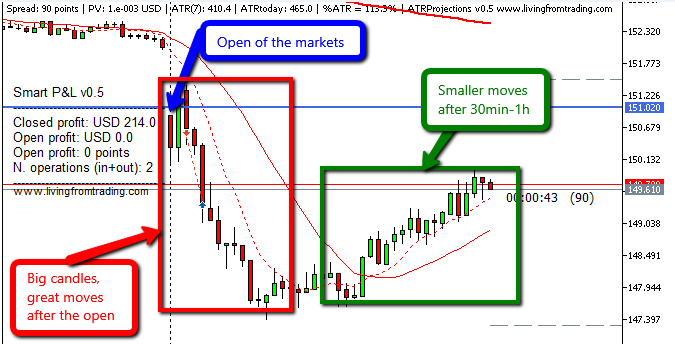

What is the best time to trade?

The best time to trade is the time when the markets are open.

When you trade forex, you only need to check the countries of the currency pair that you want to trade. If the stock exchange of one of those two countries is open at that time, then it’s a good time to trade.

Let’s take GBP/USD as an example. The two countries from that currency pair are the UK and the USA. So, the best time to trade GBP/USD is when the London market is open or when the US market is open.

And if there are important news releases affecting those countries, then it’s even better with the volatility increased. As long as you know how to trade news releases, you’ll be fine.

When you trade stocks, you can only trade them when the stock market is open. Even if your broker allows you to trade after the market closes, it’s better to trade only when the market is open.

Especially the first hour right after the markets open. That is the best period to trade stocks. The stock price moves steadily, the trading signals are clear and the noise is much lower than in the other parts of the day.

When you trade indices, you use the same concept.

If you are trading DAX, the German index, then you should trade it during the London session. The best time to trade DAX is right at the London session open, during the first 1-2 hours.

If you are trading Dow Jones or S&P500 or any other US index, then you should trade them when the New York session is open. Similar to DAX, the best time to trade Dow Jones and S&P500 is right at the New York open, during the first 1-2 hours.

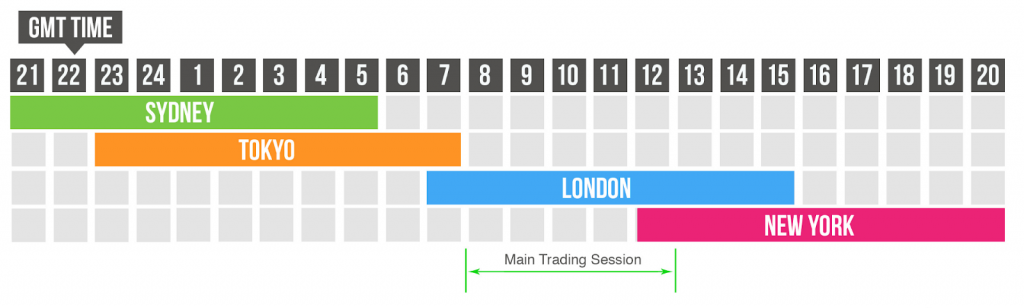

How many trading sessions exist?

There are four main trading sessions: European (London), US (New York), Asian (Tokyo), and Australian (Sydney).

Here’s an image of the trading sessions around the world within a 24-hour period.

You can see that some of the trading sessions overlap with others at some point.

During those overlap periods, the markets have an increase in volatility, which means they are good times to trade those markets.

5 – Commissions

Commissions charged by your broker may have a high impact on your trading performance.

The impact may be so high that it may be the difference between being profitable or just losing money trading.

What is a trading commission?

A trading commission is a fee that your broker may charge when you open, and sometimes also when you close, a trade.

Typically, brokers without commissions have higher spreads.

On the other hand, brokers that charge commissions have lower spreads.

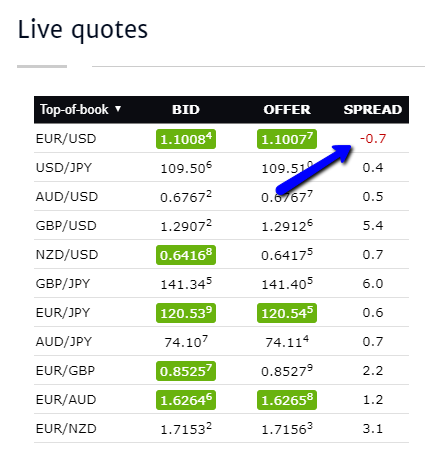

This low spread sometimes can go as low as 0, like this one.

I already even saw brokers offering negative spreads, like AmendaFX!

(Keep in mind that I never used this broker so I’m not making any recommendation about them)

Look at their advertising:

And you can actually see those negative spreads appearing on their live quotes.

Note that this screenshot was taken after the market close when the spreads are typically higher than during the day.

On the other hand, you know that brokers get money from the spread that you pay.

If they reduce the spread so much, they are reducing their profits a lot, or may even be losing in the negative spread case.

So, what’s the catch?

Well, they charge commissions to cover the reduction of the spread.

They give you with one hand, and they take it with the other.

And this leaves you with a question.

Should you choose a broker with or without commissions?

A broker that doesn’t charge commissions typically has higher spreads.

The opposite is also valid, a broker that charges commissions usually has lower spreads.

The first thing that you want to do is to see how much the price needs to move in order to cover the commission that you pay.

Then you add that value to the spread that the commission broker charges. You end up with an “increased spread”.

And now, you just have to compare the “increased spread”, with the spread of the broker that has no commissions.

The one that has a lower value wins!

Let’s go through an example of commissions in stocks trading:

Broker A charges $20 in commissions for every 100 shares (including open and close of the trade).

That broker has an average spread of $0.05

Broker B charges no commissions. On the other hand, the average spread is $0.30.

Which one should you choose?

First, let’s calculate the “increased spread” for the commission broker.

So, how much does the stock need to move in order to cover the $20 commission?

Since you are buying 100 shares, the stock needs to move $20/100 = $0.20.

It means that only after the stock price moves $0.20 in your direction, the commission’s cost is covered.

Now you add that value to the spread.

And you end up with the “increased spread” = $0.20 + $0.05 = $0.25.

Now, you compare the “increased spread” with the broker B spread, which charges no commissions.

In our example, broker B has a spread of $0.30.

Broker A’s “increased spread” is $0.25.

This means that if you opt for broker A, you pay less spread + commission.

Your trades enter the profit zone sooner than when you are using broker B.

These same calculations can be made for forex currency pairs and indices.

Let’s see an example using a forex currency pair.

Broker A charges a $7 commission per 1 lot per trade (in + out). The average spread on that broker for EUR/USD is 0.2 pips.

Broker B charges 0 commission, but the spread is 1.0 pips for EUR/USD.

Which broker should you choose?

Broker A charges a $7 commission for 1 lot.

When 1 lot size moves 1 pip, it makes $10 in profit.

This means that the price needs to move 0.7 pips in your direction in order to cover the $7 commission.

Now we calculate the “increased spread” for broker A = 0.7 pips + 0.2 pips = 0.9 pips.

Now we compare with broker B, which charges no commissions.

Broker B has a spread of 1.0 pips.

Which is bigger than broker A’s “increased spread” of 0.9 pips.

This means that when you trade with broker A, you get a profit sooner than trading with broker B.

This is the way that you can use to choose what broker should you choose to trade with regarding the commissions.

It’s valid whether you are trading stocks, forex, or indices.

Should I trade forex, stocks, or indices?

Stocks:

- It requires a higher amount of capital to trade due to the low leverage.

- The percentage of returns is low also due to the low leverage.

- Commissions may be high.

- They have the best volatility, which means more accurate signals and trends.

Forex:

- It requires a lower amount of capital to trade due to the high leverage.

- The percentage of returns is potentially bigger although it may be dangerous if you take unnecessary risks.

- Usually, it has no commissions.

- The volatility could be better most of the time, which means less accurate signals and trends.

Indices:

- They are somewhere in the middle between forex and stocks.

- The leverage is not giant like forex but it’s enough to trade without a big amount of capital.

- They have good volatility and they deliver good signals and trends.

- On the con side, the amount of choices is small. You have a lot of forex pairs and stocks to choose to trade. On indices, you only have a small amount. If they are slow during some particular days without presenting good opportunities, you may not have an alternative index to trade. You need to wait for the next day.

After measuring all pros and cons, indices are my favorite to trade although forex and stocks are also good options.

Conclusion

Either forex, stocks, or indices have their own pros and cons.

The amount of available capital to trade and the time of the day that you can actually trade, are usually the most important factors in order to choose which one is better for you to trade.

Keep your motivation even if you wanted to trade stocks and you can only trade forex.

You can be profitable and make a living from trading any of those markets.

What about you, what market do you prefer to trade?

I want learn more about indices in forex market

Kojo,

You can take my free trading course by subscribing in the home page.

You can also subscribe to my Youtube channel where I regularly post new content:

https://www.youtube.com/channel/UCh1rhVLubRdZueVG2fy8KKg?sub_confirmation=1

Thanks

Glad to know you liked it, Trevor.

goood read… good insights very ellaborate…

Thank you Braze.

I am now educated more. Thankyou.

Glad that you liked it, Matt.