Did you notice that the oil price went into negative prices?

How can that happen?

In this article, we are going to cover the oil crash, which made the oil be traded at negative prices and how we as traders can benefit from that.

And now you ask, negative prices, what do you mean with that?

Well, we’ll get back into this in a moment.

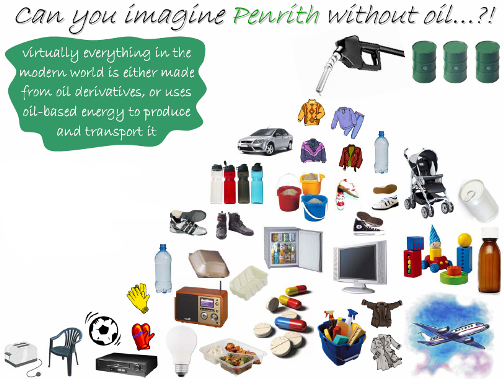

Let’s talk about the importance of oil in our lives.

Where do we have oil?

Oil is one of the biggest commodities out there. It’s not important just for fuel, diesel or gasoline, it’s on everything.

It’s in:

- motor oil;

- all kinds of rubbers (that you have on your shoes, on your tires);

- plastics (like trash bags, shopping bags, water pipes, televisions, cd players, anything that has plastic in it);

- chemical products (like solvents, paint, fertilizers, insecticides and even pills) ;

- makeup products (like lipstick and hair coloring);

- body products (toothpaste, shampoo, shaving cream, soap);

- clothes;

Oil is everywhere, even in groceries, an orange or an apple that you may be eating.

They needed to be transported to your supermarket, and the truck that made that uses oil.

So, oil is everywhere, even in the products that don’t have it on their composition, oil was used somehow for that products to reach you.

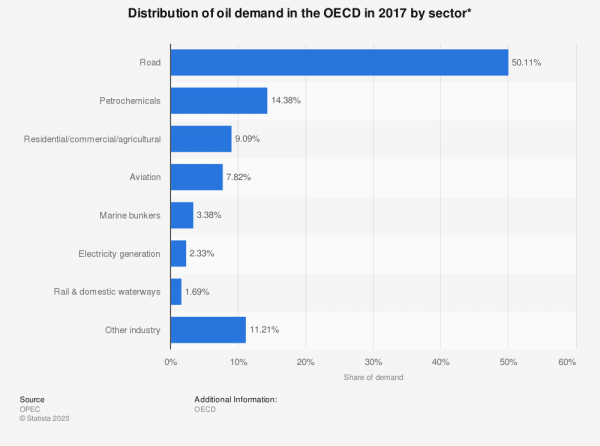

And, although oil is everywhere, the main consumption comes from transportation: airplanes, ships, cars, trucks. And that represents around 60% of the oil consumption.

With everything that is going on right now, much fewer people are traveling. Commercial flights are stopped, and the same for cars, because people are at home in quarantine and they just don’t use their cars because they are not going anywhere.

Factories are also closed, and they also consume a big amount of oil.

And all of that together, made the oil consumption to have a huge decrease.

At the same time, the oil kept being produced and extracted.

Why do they keep extracting oil?

If the oil price goes down a lot, the extraction is not worth it, the money that they spent to extract the oil, is more than the money that they get from selling it.

Usually, when there’s a demand decrease, the OPEC, which stands for Organization of the Petroleum Exporting Countries, and other countries like Russia, they meet and decide to decrease the extraction.

They try to manipulate the prices to keep them at sustainable levels.

Well, in a recent meeting, Russia didn’t agree to cut the production and started to ramp the production instead of decreasing it.

Saudi Arabia got offended by that, and they also started to increase their production of oil. Everyone started to increase their productions to maximum speed.

And that leads to a war on oil prices.

They all just kept extracting everything they could and that lead to a huge amount of supply.

At the same time, there’s a very small amount of demand, no one is interested in buying it.

And what it happens, when there’s more supply than demand, the prices just drops.

The biggest difference between the supply and demand, the more the price drops.

And when the difference is really huge, well the price collapses, and that’s what happened.

But how can they drop into negative values?

Basically, the companies that were selling oil, were paying to sell their oil.

Let’s take a look into that.

Why would an oil company pay someone to take their oil

First, oil companies have to store their oil. And with such a lack of demand they didn’t have more space to store it. And there’s also a cost to store oil.

So, literally, the oil companies just paid people to take their oil.

Second, oil is mostly traded by futures contracts. Each contract is for 1000 barrels of oil.

A futures contract is an agreement between a buyer and a seller. And theses futures contracts have an expiration date of 3 months. At the end of these 3 months, the sellers that own contracts have to deliver oil at the price that they agreed to sell, and the buyers that own the buy contracts have to actually pick up the oil that they bought.

But most people that trade futures, they do it just for speculation reasons. They have no interest in actually buying or selling real oil. They just want to profit from the price fluctuations.

If you owned a contract to buy oil at the end of the futures contract, you would have to pick up 1000 barrels of oil for you…

Would you want to do that?

As the oil futures contract was reaching to an end, all these speculators that owned contracts to buy oil, just wanted to get rid of them.

But no one was interested in buying them, no one wanted to buy oil.

So they had to pay for someone to take their contracts for buying oil.

Who is going to benefit from this?

All companies that use a lot of oil and that can store it will have a huge benefit.

First, we have the airline companies.

Airline companies are getting lots of losses at the moment. On the other hand, they are very needed, and governments can’t afford to let them go bankrupt. They will get support from the governments and when this crisis passes they will have a huge grow.

We all know, one of the biggest expenses that they have is in fuel. As they are seeing fuel at sales price they can buy everything that they can and accumulate.

The better thing, is that they don’t even need to store the oil at the moment.

Using futures contracts, they can buy the oil now, and only get it in 3 months, when the futures contract expires.

Other sectors that are going to get benefit from this are the cruise companies and even road transportation companies.

What will we see now?

With such low prices for oil, most of us will benefit from that. We can put cheaper fuel in our cars, the cost of products may decrease because the cost of transportation also decreases.

But not everything is good.

A lot of oil companies are going bankrupt.

Thousands of people will be losing their jobs.

And as the oil companies close, the amount of supply starts to decrease, and when it matches or is actually less than the level of demand, the prices will start to increase until they reach a level where it’s sustainable to extract oil.

Meanwhile, we as traders, just benefit from that.

How can we trade oil?

This kind of war brings a lot of volatility to the markets, and that’s the most important thing to make money trading.

We make money when the markets move.

We want to see them moving a lot, the more the better and these last months have been a real blessing for everyone that is trading and knows how to do it.

This is the kind of trades that we do in LFT trading room.

Find good trends, and follow them in the most simple possible way.

And that is waiting for pullbacks and enter in the direction of the trend.

Oil has been a real ATM in this last days.

What about you, are you using this period of high volatility to make money?

Leave a comment below to let me know.