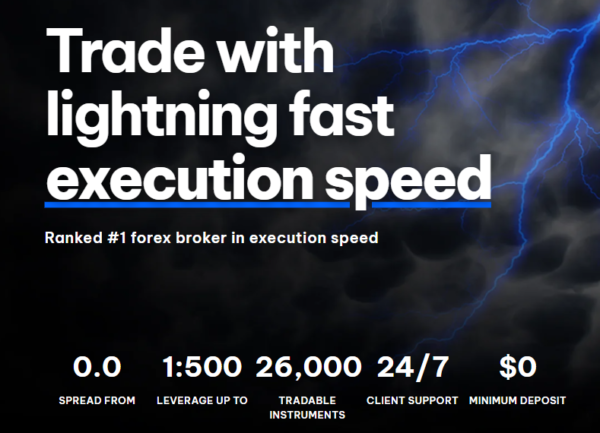

BlackBull Markets is a multi-regulated forex/CFDs broker located in New Zealand. This review will go over all the features that are offered, like the 26k+ assets available to trade, and a leverage that can go up to 1:500.

In this article, you’ll get a review of this broker, including analysis and instructions to open an account with BlackBull Markets.

Here’s what you’re going to learn:

- What is BlackBull Markets?

- What Can You Trade With BlackBull Markets?

- What Is The BlackBull Markets Minimum Deposit?

- What Is The BlackBull Markets Leverage?

- BlackBull Markets Reviews

- BlackBull Markets Regulation

- BlackBull Markets Trading Platforms

- BlackBull Markets Account Types

- BlackBull Markets Professional Account

- BlackBull Markets Deposit Bonus

- BlackBull Markets No Deposit Bonus

- BlackBull Markets Contacts And Headquarters Location

- BlackBull Markets Payment Methods

- BlackBull Markets Negative Balance Protection

- BlackBull Markets Margin Call

- BlackBull Markets Margin Stop Out

- BlackBull Markets Micro Account

- BlackBull Markets Free VPS

- BlackBull Markets Inactivity Fee

- Is BlackBull Markets Legit?

- BlackBull Markets Hedging

- BlackBull Markets Copy Trading

- BlackBull Markets Social Trading

- BlackBull Markets Max Lot Size

- BlackBull Markets Spreads

- BlackBull Markets Minimum Withdrawal

- BlackBull Markets Countries

- BlackBull Markets Alternatives

- Recap

What Is BlackBull Markets?

BlackBull Markets is a forex broker located in Auckland, New Zealand, and was founded in 2014.

This broker is an ECN broker, meaning that it uses electronic systems to match buy and sell orders in financial markets. This results in tight spreads, fast executions, and more transparency.

The broker is also NDD (No Dealing Desk). This ensures that your trades go directly to the market, and there’s no intervention or dealing desk manipulation.

What Can You Trade With BlackBull Markets?

BlackBull Markets is a Forex broker that gives you a wide range of instruments to trade besides Forex. While writing this review I was surprised by the number of instruments. With over 26k tradable assets, you won’t have a hard time finding an instrument that matches your trading style.

Here’s a list of all of the instruments that you can trade with BlackBull Markets:

- Forex Major currency pairs

- Forex Minor currency pairs

- Forex Exotic currency pairs

- Energies: Brent Crude Oil, WTI Crude Oil, and Natural Gas

- Metals: Silver, Gold, Platinum, Palladium, and Copper

- Indices: A wide range that includes Dax, Dow Jones, Nasdaq, SP500, AUS200, CAC40, FTSE, and much more

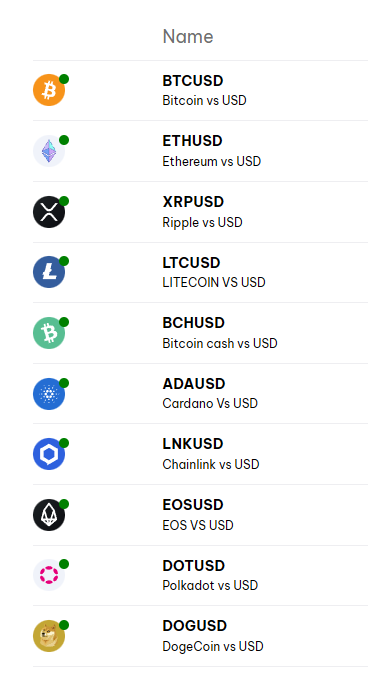

- Crypto: The offer is pretty big, it includes BTC, ETH, LTC, XRP, ADA, DOGE, DOT, LINK, and more

- Stocks: All major US stocks are there, like TSLA, META, AAPL, and more.

What Is The BlackBull Markets Minimum Deposit?

To open a real account with BlackBull Markets there’s no minimum deposit. You can deposit whatever amount that you want to trade with.

You don’t need to deposit anything if you’re just trying the broker and testing a demo account.

What Is The BlackBull Markets Leverage?

The BlackBull Markets leverage varies according to the product that you are trading.

The maximum leverage is given to Forex and Metals. Other products have a reduced leverage, which is normal with CFDs brokers, but still a good amount of leverage.

Here’s the leverage provided by BlackBull Markets by instrument category:

- Forex: 1:500

- Indices: 1:100

- Metals: 1:500

- Energies: 1:100

- Stocks: 1:5

- Crypto: 1:5

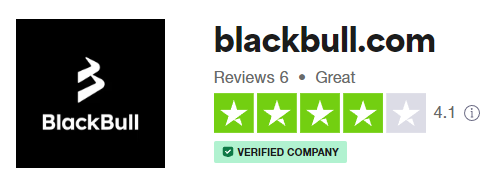

BlackBull Markets Reviews

According to Trustpilot, BlackBull Markets is classified as great. It’s scoring an impressive 4.1/5.0. It just doesn’t have many reviews, only 6.

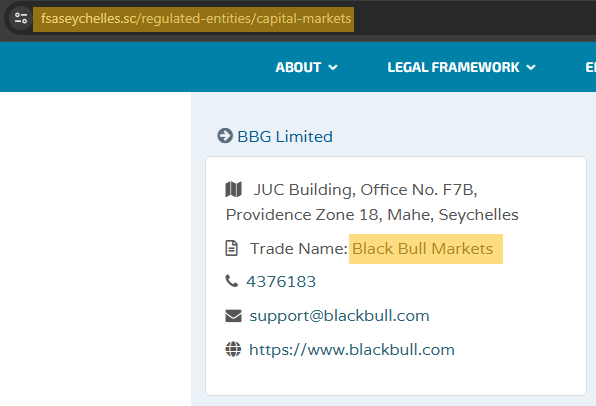

BlackBull Markets Regulation

When you open an account with BlackBull Markets, you can be sure that you will be trading with a regulated broker.

The group has several companies across the world, registered or regulated in multiple locations. It has branches registered as a Financial Services Provider in New Zealand, the UK, and Seychelles.

The regulation comes from the FSA (Seychelles Financial Services Authority).

In case you’re wondering if the regulation claim is fake, I went to check myself. I could verify that the broker is regulated by the FSA and registered as BBG Limited. Here’s the proof:

BlackBull Markets Trading Platforms

BlackBull Markets gives you access to the most popular trading platforms used by Forex brokers.

You can use:

- MetaTrader 4

- MetaTrader 5

- TradingView

You can use TradingView to trade, but the best of all is that you are eligible to have a Premium TradingView plan for free. The only condition is that you trade at least 10 lots per month. It looks like a good deal to me.

- cTrader

- BlackBull CopyTrader (proprietary)

- BlackBull Invest (proprietary)

They also have web and mobile versions, meaning that you can easily trade wherever you are.

BlackBull Markets Account Types

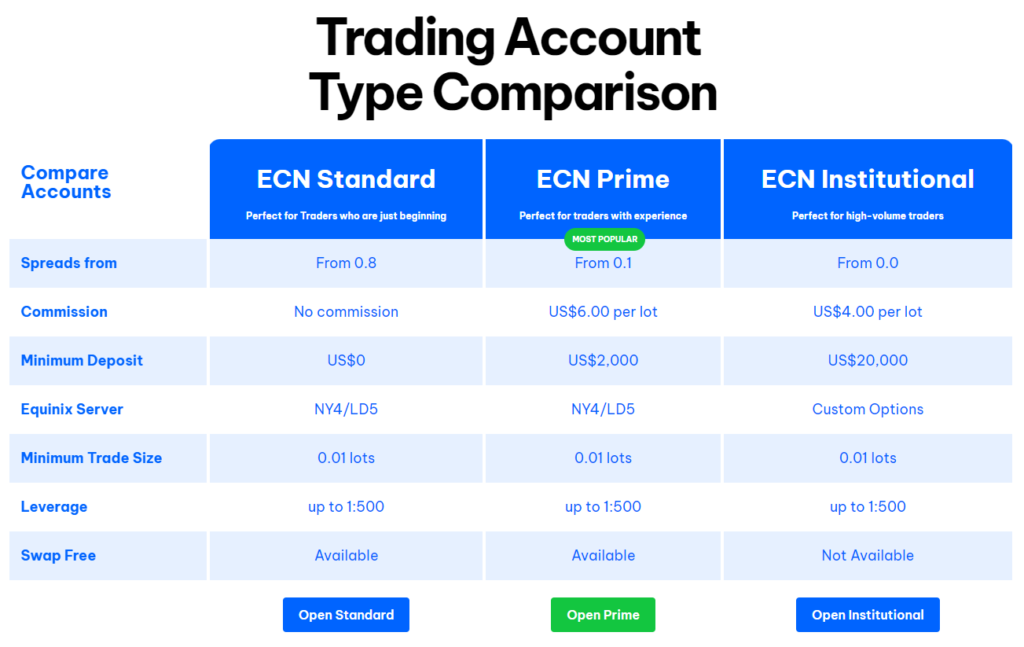

There are three main account types provided by BlackBull Markets.

They are:

- ECN Standard account: The best account for beginners. Spreads from 0.8 pips, no commissions, and no minimum deposits. Available as an Islamic (swap-free account).

- ECN Prime account: The best account for traders with experience. Spreads from 0.1 pips, commissions from $6.00 per lot, and a minimum deposit of $2,000. Available as an Islamic (swap-free account).

- ECN Institutional: Ideal for high-volume traders. Spreads from 0.0 pips, commissions from $4.00 per lot, and a minimum deposit of $20,000.

BlackBull Markets Professional Account

BlackBull Markets offers an Institutional account, which is meant for high-volume traders.

You get the same high leverage as in the other account types.

The main differences are the lower spreads and commissions. A bigger deposit is also required which is at least $20,000.

BlackBull Markets Deposit Bonus

BlackBull markets don’t offer a deposit bonus. On the other hand, you can get awarded up to $250 for referring a friend.

BlackBull Markets No Deposit Bonus

Unfortunately, BlackBull Markets doesn’t offer a no-deposit bonus for new clients.

You can get a deposit bonus though if you refer a friend. Check the previous chapter of this article.

BlackBull Markets Contacts And Headquarters Location

If you need to contact BlackBull Markets here are their contacts and location:

- Email: support@blackbull.com

- Phone: +64 9 558 5142

- Address: Level 20, 188 Quay Street, Auckland Central, 1010, New Zealand

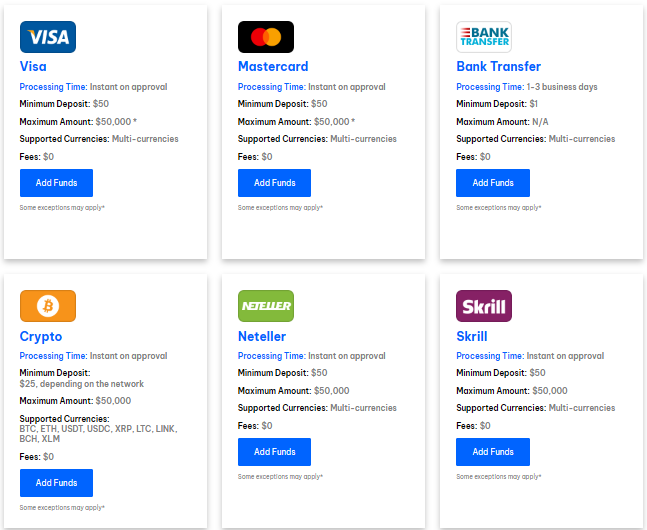

BlackBull Markets Payment Methods

BlackBull Markets accepts a wide range of methods either to deposit or to withdraw.

Some of the payment methods may not be available, depending on your country.

Here’s a list of them:

- Credit and debit cards

- Neteller

- Skrill

- Wire Transfer

- Crypto

- POLI

- Use Pay

- PaymentAsia

- HexoPay

- Help2Pay

- FXPay

- China Union Pay

- Boleto

- Beeteller

- Astropay

BlackBull Markets Negative Balance Protection

Yes, BlackBull Markets offers a negative balance protection.

It’s not explicit on their contracts though, to prevent traders from abusing the system. Make sure that you contact them about this matter if this is important to you.

BlackBull Markets Margin Call

The BlackBull Markets margin call is 70%.

This means that you always need to maintain an equity that is bigger than the margin required to keep your positions open.

If your equity (Balance + Open Profit or Loss) falls below the required margin you will receive a margin call.

BlackBull Markets Margin Stop Out

The BlackBull Markets margin stop-out level is 50%.

What this means is that your free margin must always be above 50%. If it falls under this value, the platform will start to automatically close your positions to keep the free margin above the threshold.

Typically, the positions are closed from the largest losing position to the smallest one.

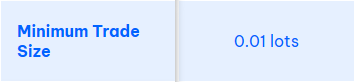

BlackBull Markets Micro Account

BlackBull Markets offers Micro Accounts to its customers.

This means that you can trade using micro lots, equivalent to 1,000 units of the base currency, which is the same as trading with a 0.01 lot size.

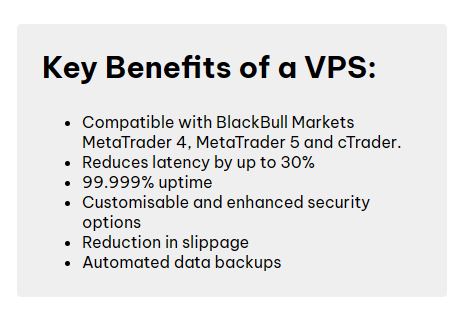

BlackBull Markets Free VPS

BlackBull Markets offers a free VPS subscription if your trading volume exceeds 20 lots per month, in Forex currency pairs or Metals.

Your account balance also must be at least $2,000 if you want to get the free VPS.

These VPS providers reduce the latency by up to 30%. Slippage is also reduced by having a faster connection.

If your thing is EA trading, and your trading volume exceeds the minimum threshold, then apply to your free VPS.

BlackBull Markets Inactivity Fee

There’s no inactivity fee with BlackBull Markets. This is great because you can stop trading for the time that you want, and you can be sure that no inactivity fee will be charged to you.

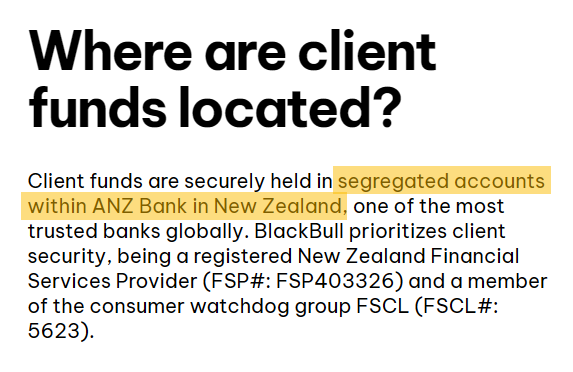

Is BlackBull Markets Legit?

Yes, BlackBull Markets is a legit broker and company and your funds will be securely held in segregated accounts. These accounts are in the ANZ Bank in New Zealand, one of the most trusted banks.

The client security is important for the broker.

BlackBull Markets Hedging

There are no restrictions against hedging with your BlackBull Markets account. Heding accounts are the default with BlackBull Markets.

This means that you can open long and short positions on the same symbol at the same time.

If you don’t like hedging accounts, there’s also an alternative. They are called the NET accounts. With these types of accounts, on each specific symbol, you can only have one single position in one direction.

Net accounts are especially useful when you want to be able to add and reduce your position size.

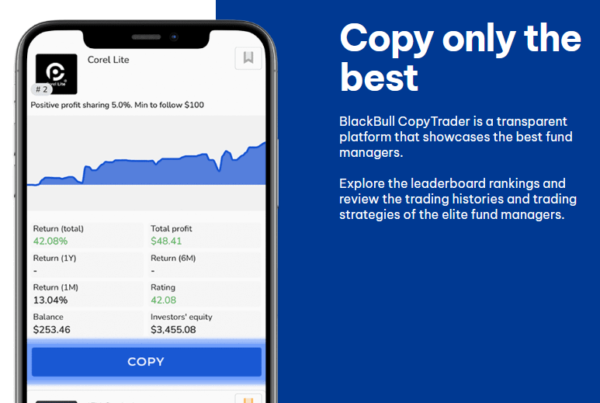

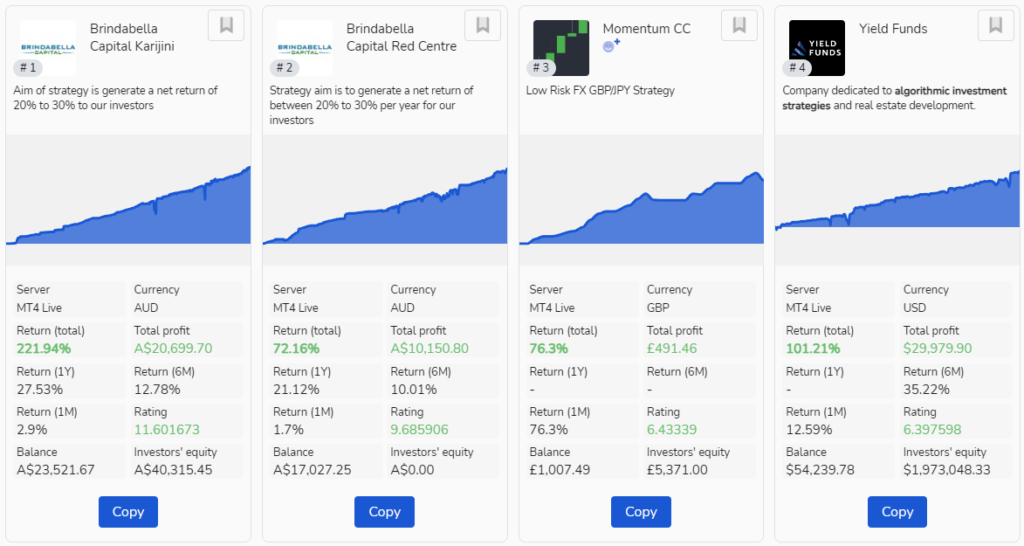

Is Copy Trading Allowed With BlackBull Markets?

You are allowed to do copy trading on your BlackBull Markets account.

The signals you copy can come from any source but the great thing here is they even have their own copy trading software that you can use. It’s the BlackBull CopyTrader.

The BlackBull CopyTrader is completely free either to join or to use. There’s also no minimum deposit needed to start copy trading their signal providers. On the other hand, each signal provider may set some funding parameters that you’ll need to meet to be able to copy them.

You can opt to copy-trade as many signal providers as you want. The only condition is that you have enough funds and your copy-trading parameters allow it.

BlackBull Markets Social Trading

BlackBull Markets offers a good variety of social trading sources like ZuluTrade or MyFXBook.

By using BlackBull Market’s social trading, you can copy trading strategies from other traders, replicating their performance. Just make sure that you choose your sources wisely to make the most of BlackBull Market’s social trading features.

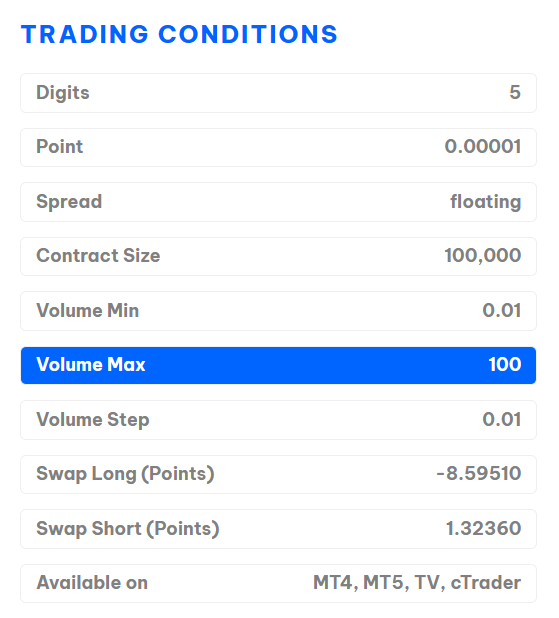

BlackBull Markets Max Lot Size

When trading BlackBull Markets forex currency pairs, your lot sizes start at 0.01 and can go up to 100.

If you trade other symbols, like indices, or metals, the maximum lot sizes may vary.

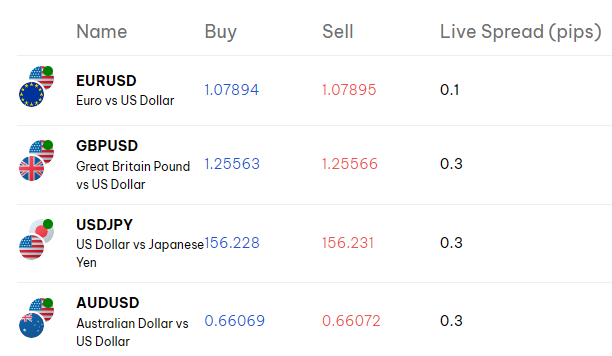

BlackBull Markets Spreads

BlackBull Markets has spreads starting as low as 0.

It depends on the account type that you choose though.

For most Forex currency pairs, the minimum spread is as low as 0, when you choose the ECN Institutional Account. This account charges commissions based on the lot size that you trade with a value of $4.00 per lot.

The ECN Prime Account offers spreads starting from 0.1 pips. It charges commissions too. In this case, the commission is $6.00 per lot.

On the other hand, the ECN Standard Account doesn’t charge any commissions. The spreads will also be bigger, starting from 0.8 pips.

BlackBull Markets Minimum Withdrawal

The minimum amount to be able to request a withdrawal from BlackBull Markets is $1. This may change based on the withdrawal method that you chose.

However, there’s a withdrawal fee of $5. So, although you don’t need to meet a minimum withdrawal amount with BlackBull Markets, you must be aware of these fees that can reduce considerably the amount that you receive if your withdrawal amount is very small.

BlackBull Markets Countries

BlackBull Markets accepts residents from all over the world except some specific countries. BlackBull Markets doesn’t accept clients from the United States, Canada, and OFAC-sanctioned countries.

How To Open An Account

To open an account with BlackBull you just need to fill out their account application.

After that, you’ll be prompted to send some identification documents which are:

- A valid form of government-issued identification (Driver’s License, State ID, or Passport)

- Proof of residence

- Bank account information

And… it’s done!

In a short period, you’ll be able to start trading.

BlackBull Markets Alternatives

Here is a list of the best BlackBull Markets alternatives:

Recap

- BlackBull Markets is a regulated broker that allows you to trade Forex currency pairs, Energies, Metals, Indices, Crypto, and Stocks.

- There’s no minimum deposit to start trading. Deposit as low as you want.

- The popular MT4 and MT5 platforms are available to trade, as well as TradingView and a copy-trading service.