Forex news releases often turn the market into a savage beast.

Forex news releases often turn the market into a savage beast.

The same happens when trading stocks, during the opening of the markets.

I believe that you already saw how the price moves so quickly during these moments.

And probably you already tried to make profitable trades during high volatility, right?

If you know what you are doing, day trading can make a lot of money in a short amount of time.

But if you don’t have a good trading strategy, you’ll just end up losing.

During this trading school class, you’ll learn why trading news releases and trading the open of the markets are the best times of the day to trade.

And I’ll also teach you how you can find what time of the day YOU should trade and it’s more profitable for you to trade.

Before starting I just want to tell you that this is not about straddling, nor about putting pending orders before news releases, nor about trading without a stop loss.

This is not about anything that you are thinking about.

This is fresh new air to your head!

Trading forex news releases and the open of the stock markets

What I would like to talk to you is about a topic that is very special to me.

It has a special place in my heart.

And that topic is about trading forex news releases and trading the open of the stock markets like a real professional!

Yeah, you read it right: news releases, open of the markets, high volatility moments!

Exactly the time that everyone tells you to avoid!

I hear a lot:

“I always close my trades prior to important news releases.”

“You should wait at least 15-30 min after the news to start trading again.”

For me, that’s just nonsense if you know what you are doing.

Want to know why?

Just keep reading this trading school lesson carefully and your market view will change a lot!

Market phases

The market is truly divided into four different phases.

Each of those different phases has a completely different set of characteristics.

It’s like there are four different markets during the day.

And you know what, a lot of traders don’t understand this!

A lot of traders ask why they go so well at a certain time of the day.

And they don’t even have the consciense that the day can be divided into small daily pieces.

What does this mean?

This means that the concepts and strategies that you use should be adapted to each part of the day.

If not, your strategy will probably be in sync with some parts of the day, but not with the other parts of the day.

So, when a new phase characteristic kicks in, the concepts that you used for the previous phase, may not be appropriate for this new phase.

“I do very well in the morning, and I lose all my profits in the afternoon.”

“I do horrible in the morning, I’m a boss during the afternoon.”

You must understand that you are talking about different financial market phases.

Different markets inside the same market, on the same day.

Different characteristics.

That’s why I teach the traders from LFT trading school, how to understand the characteristics of each phase.

How to be prepared to trade in a profitable way on each different phase.

How to invest in stocks or how to trade forex, on each phase of the day.

How to distinguish between phase 1 and phase 2, when it starts.

How to trade these different financial markets, these different animals!

Keep reading and you’ll get a lot of that knowledge too.

Tools

Do you use any tools to analyze your trades?

No?!

But you should, really, that is one of the most important aspects to make your trading strategy more accurate.

LFT trading school has a set of tools that help traders to identify which phase of the day they perform better.

Which phase of the day favors them.

This way, the trading day can be split and analyzed separately.

This will show you that you are a beast trading some parts of the day and that you suck, at trading another time of the day.

Can you see the tremendous hedge that this can be to a trader, to you?

This way you can clearly identify when you are in sync with the market, and when you are completely out of what you should be doing!

Usually, most traders have no idea about this.

You need someone that shows you the reality.

If you don’t do it yet, start to write down all your trades, their result, and the time of the day.

It’s as simple as using an excel spreadsheet.

Then you just need to filter your trades by time.

Check how much accumulative profit you have on average between 9:00-10:00, then between 10:00-11:00, and so on.

You don’t know how to build a spreadsheet to analyze your trades?

That’s not really a problem.

There are some online tools that you can use to analyze your trades.

One that I like to use a lot is https://www.fxblue.com.

You can import your trading history automatically to their website and perform a huge number of different analyses.

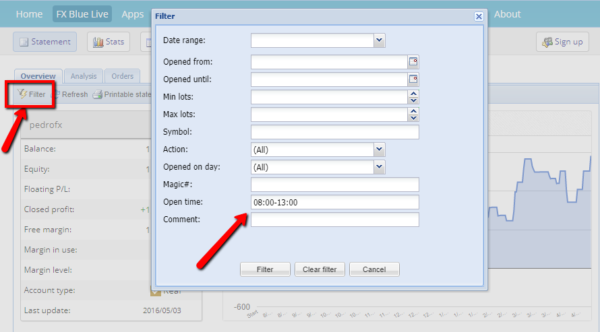

Look how the time filter works:

In this example, I’m setting a filter so that my growing curve is formed just by the trades I took during London session news releases.

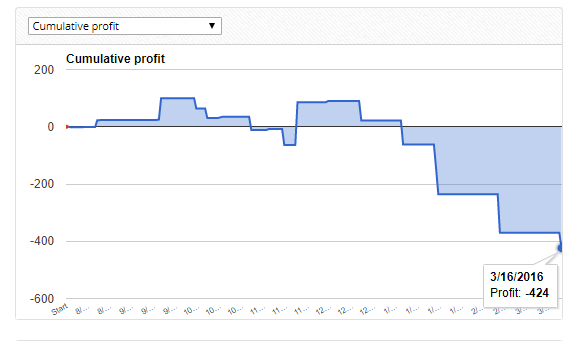

And this is the result that I got:

I found that for this particular trading strategy, I was losing money trading forex news releases during the London morning session.

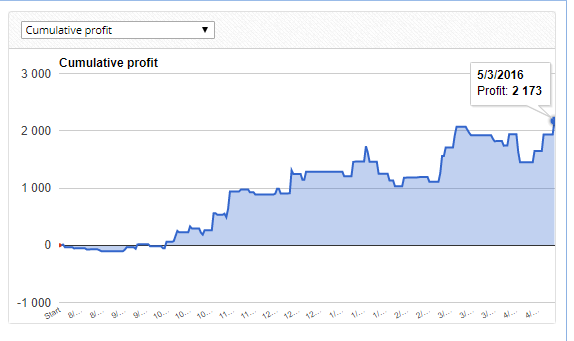

Then I analyzed the trades that I took outside of the London morning session.

And this is the graph that I got:

Do you see how clean is the account growing?

What conclusions did I take from this analysis?

Well, with this particular trading strategy, I should stop trading news releases during the London session morning.

I was just losing money there.

You should do the same kind of analysis of your trades.

Besides myfxblue.com you can also use https://www.mql5.com/

You cannot do the same analysis on both, so use both, and take the most of what they can offer you when it comes to analyzing your trades.

If you have times of the day when you are consistently losing, then probably you should stop trading during those periods.

Or adapt your trading strategy to those specific times.

But most important, focus on the times of the day when your trades have the most profitability.

That’s what is working for you!!!

One trade a day keeps poverty away if you know what you are doing!

Times of the day

You can see a lot of articles saying that the morning is the worse time of the day to trade.

The opening of the markets is where people lose more money.

The same as when you have high-impact news releases.

When in fact, it’s exactly at that time that I make my most profitable trades.

When my winning % is higher.

And this is what is called phase 1.

That lasts something like 20-30 minutes a day.

The first minutes after the opening of the stock markets.

Or the first minutes after a forex high-impact news release.

Then it comes to phase 2, where the market has different moves, different strengths, and a different set of characteristics.

Different rhythm.

Phase 1 is the most lucrative time.

It has the highest amount of volatility.

That can be good or bad, depending on if you know what you are doing.

You need to be trained for it.

Volatility hurts and is an enemy if you don’t know how to handle it.

We need volatility, we want volatility, and we want the price to move!

My average trading day is 15-30 minutes.

You can do the same, and you can go to your job after that, you can do whatever you want.

You don’t need to be the whole day, standing in front of your trading monitor, to be profitable, to win big.

You just need 1 trade a day, 2 trades a day.

No more than that!

Differences between forex and stock market trading periods

So, we are looking for time periods where the volatility is the highest.

When trading stocks, the highest volatility period is the opening of the US markets.

The first 20-30 minutes are the best and that’s phase 1.

That’s when you find the best stocks to buy.

Look at this example of AAPL at the open of the markets:

Then it comes to phase 2, the price starts to slow down.

The price movements are slower, around 50% of the movements that we had in phase 1.

This is still a good period to make money trading.

Then, around 3 hours after the open, the market stalls, it doesn’t go anywhere with conviction.

This happens because a lot of the big players are already out of their trades.

They made their daily profit and now they go and have lunch.

You get a lot of erratic movements, the signals are not clear.

You should be away from the markets during this time.

After lunch, phase 4 starts.

Some big players come back to get some more juice from the markets.

Similar to phase 2, you may find some good opportunities to trade.

And what is the best time to trade forex?

On forex, we don’t really have open time.

We have the Asian open, the UK open and the US open.

The market opens at different times on each continent, so the open volatility is not really high compared to trading stocks.

Big players are split between those periods.

You have two choices:

1 – Wait for a quick movement/momentum to start on a currency pair and then get into the train while it lasts.

This can be quite boring, because you may have to wait several hours for the right time to come.

But on the other hand, it’s quite effective, and you get some really good trades if you have patience enough to wait.

2 – Trade just high impact news releases.

That’s right, during these periods the markets get enough momentum to give clear signals and great trading opportunities on low time frames.

While on stocks I usually trade the 2 minute time frame (M2), on forex I frequently go as low as the 1 minute time frame (M1).

That’s the time frames that you need to use to get the best trades and be able to use that temporary momentum in your favor.

Conclusion

As a trader, you should always look for volatility.

That’s when the price really moves, that’s when the trading setups really work.

That’s when you can get the most profit from your risk.

Run away from your charts when the market is slow and choppy.

Nothing works at that time.

You’ll just lose money trading.

Wait for the best moments.

Give preference to trading high impact news releases on forex.

Give preference to trading New York markets open on stocks.

But you need to be trained.

I can teach you how to master this part of the day.

And when you get it, when you become a specialist on it, my goodness.

This is a very lucrative time because the majority is losing.

If the majority is a depositor and leaving their money there, someone is picking their money.

Why shouldn’t be you?

Why shouldn’t be you one of the ones that make the withdrawal?

New York (open 8 a.m. to 5 p.m.): New York is the second-largest forex platform in the world, watched heavily by foreign investors because the U.S. dollar is involved in 90% of all trades, according to Day Trading the Currency Markets (2005) by Kathy Lien. Movements in the New York Stock Exchange (NYSE) can have an immediate and powerful effect on the dollar. When companies merge and acquisitions are finalized, the dollar can gain or lose value instantly.

In the trading room, we especially like to trade the open of the markets. Trading DAX right at London open and trading Dow Jones and US stocks right at New York open. Moments with volatility, like the open of the markets and news releases, it’s when we get the biggest profits.

Great work! This is the kind of information that are meant to be

shared around the net. Disgrace on Google for not positioning thiis put uup upper!

Come on over and consult with my site . Thanks

=)

Thanks!

I quite like reading a post that can make men and women think.

Also, thanks for allowing me to comment!

Comment at will.

Glad to help!

I’d like to thank yoou for the efforts you hawve put in writing this website.

I really hope to see the same high-grade blog posts by you later

on ass well. In fact, your creative writing abilities has encouraged me

to get my own, personal website now 😉

Thank you very much!

It’s remarkable for me to have a web page, which is good in favor of mmy know-how.

thanks admin

Thank you!

Your article is really informative and to the point. All the mentioned above are best for getting the stock market updates.

Glad that you liked it!