What is a Stop Loss and is it necessary?

The stop loss is a tool that traders use to prevent them from having bigger losses than what they are willing to take. It’s commonly used in any trading style.

It’s a pending order that is activated into a market order when the price reaches the level where it’s placed.

A stop loss can be hit in profitable territory if you are using some kind of trailing stop.

But typically, when a stop loss is hit, you lose money from your account.

Is that a bad thing?

No!

It’s a protection, like a safety belt.

If your stop loss was triggered, it protected you from having bigger losses.

Can you lose money with a Stop Loss?

Every time that your stop loss is hit on the losing side of your position, you will lose money.

That will not happen if you are using your stop loss to lock your profits though.

Please notice that a stop loss is not always a guarantee that your trade will close exactly at that level.

The price may gap and your stop loss can be executed at a different level.

When day trading, slippage during high volatility moments can also make your stop loss be executed at different price levels.

It’s particularly important to use a stop loss when you’re trading with leverage.

A small move against you can give you a big loss or even make your account balance turn negative.

Hard stop loss vs Mental stop loss

A hard stop loss is an order that you set on your broker’s platform.

When you use a hard stop loss you don’t need to worry about closing your trade if your maximum loss allowed is achieved.

Or if the price reaches a level where you are not willing to hold your trade for a longer period.

The system will automatically close your position for you when that level is achieved.

On the other hand, a mental stop loss requires action on your part.

You need to watch your trades more frequently in case they come against you and you need to close them.

Some brokers, especially stock brokers, don’t have a stop-loss option available.

When trading with a broker like that, you need to use a mental stop loss and make sure that you close your trade when it’s time to do it.

Traders that are scalping tend to stop their trades manually frequently.

But if you let your emotions get in the way you may get into trouble.

Where to place the stop loss?

There are several ways of placing a stop loss.

Let’s look at them now.

1 – Entry pattern stop loss

This is the most common way of placing a stop loss.

When you enter the market, you need to have a reason to enter.

If you enter based on a chart pattern, then that’s the reason for your entry.

So, when should you get out?

Simple.

When your entry pattern is deleted from your charts.

The price just goes against you and breaks your entry pattern to the other side.

Meaning that your entry reason is not there anymore.

Entry chart patterns can have different shapes, like pinbars or engulfing candles.

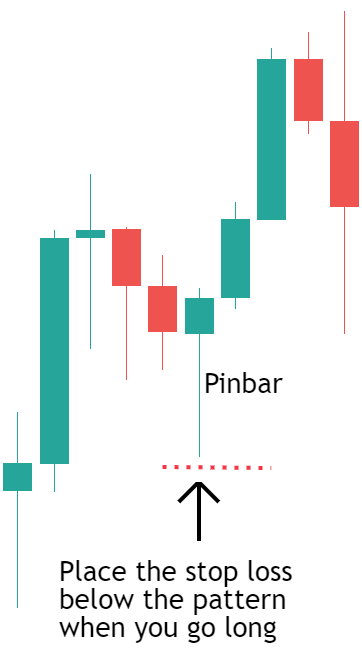

Here’s an example of where to place your stop loss when going long on a pinbar:

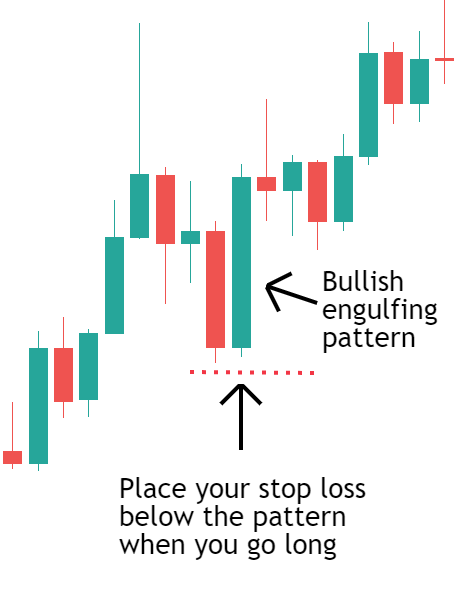

And here’s an example of where to put your stop loss when going long after a bullish engulfing pattern:

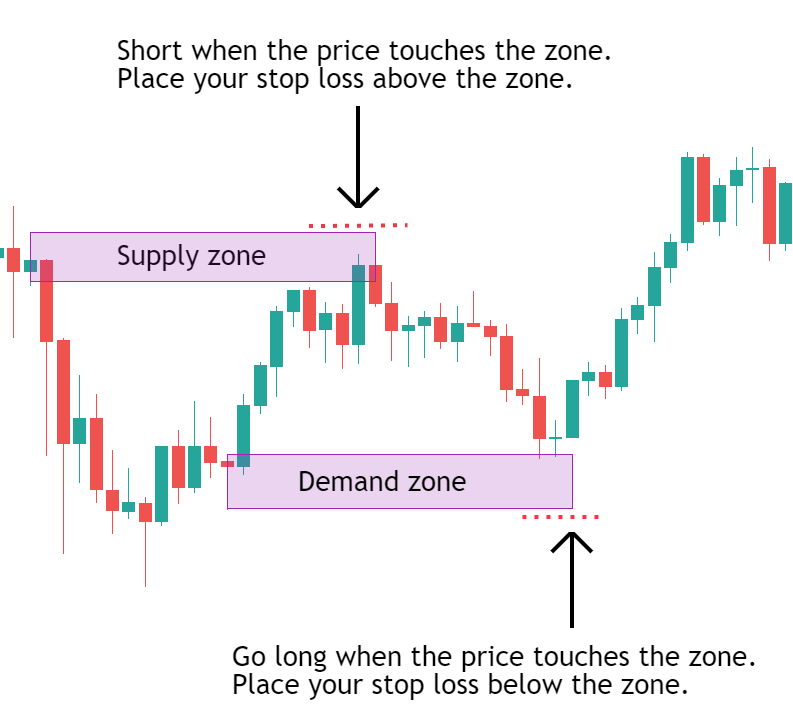

2 – Supply/demand zone stop loss

Supply and demand zones are very popular in the trading world.

Basically, they are zones or levels where the price made strong drops or rallies in the past.

When the price gets to that price level again, it tends to react to the zone and start moving to the other side.

They are good zones often used to anticipate trend changes.

But like everything, they don’t work all the time.

So we need to be protected using our stop loss friend.

Here the concept is the same as the chart patterns.

We want to put our stop loss on the other side of the zone.

Meaning that if the price breaks the zone, then there’s no reason to keep holding that trade and we should stop it.

Here’s an example of how to place your stop loss when trading supply and demand zones.

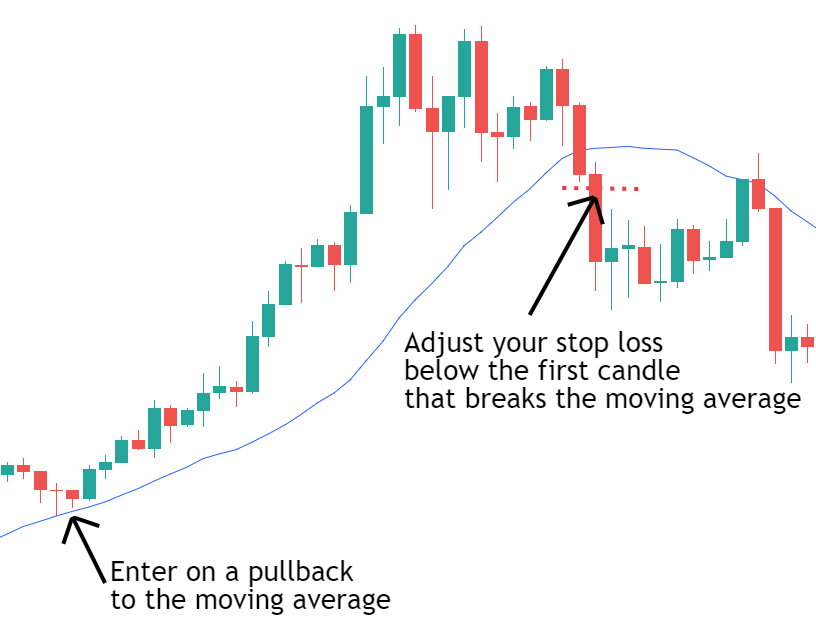

3 – Moving average stop loss

Moving averages are extremely useful to help in the placement of stop losses.

When we are trading trends, we usually use moving averages.

As long as the price is holding above the moving average, we are on an uptrend.

The opposite for downtrends.

So, what’s the key here?

Let’s say we are going long on an uptrend.

And our reason to keep the trade open is the price holding above the moving average.

When do we want to stop our trade?

When the moving average is violated.

As soon as we see a red candle, closing below the moving average, that’s our signal.

We adjust our stop loss to 1 tick below that red candle.

And if the price confirms the trend change, our trade is closed.

Here’s an example:

Notice that when we use a stop loss associated with a moving average, we may get out either in profit or in a loss.

If the price breaks the moving average right after our entry, our stop loss should be hit right there.

Pro tip

Using a stop loss with a moving average works well on trending markets. Avoid using this strategy on sideways markets.

Another important thing is the initial stop loss.

We don’t want to have a trade there alone without any stop loss, just waiting for a break of the moving average.

We may get a violent move against us.

For this reason, an initial hard stop loss should be used too, either using a pattern as a reference or a fixed maximum loss in $.

4 – Maximum loss stop loss in $

This is a common way of using a stop loss when trading without trying to time the market very accurately.

Instead, a position will be built gradually, usually inside a specific zone in the chart.

Let’s say that you are going long.

You add to your position on big declines, that qualify for exhaustion moves to the downside.

This is how institutions trade to be able to get enough liquidity to fill their orders.

When the price starts going up, adding on strong pushes to the upside, ignition candles, is also an option for you.

What you want to do is to split your bullets between several smaller trades in different zones.

If the price just keeps going down and proves that you were not right you only have one more thing to do.

Close your trade, activate your mental stop loss.

The key here is not to lose track of a maximum stop loss.

Check actively if your overall position exceeds the maximum value in $ that you defined.

If it happens, you just close it, and that’s the same as a stop loss being hit.

Better trades will appear.

Locking profits with a Stop Loss

A stop loss isn’t only used to lock potential losses.

It can also be used to lock profits.

How?

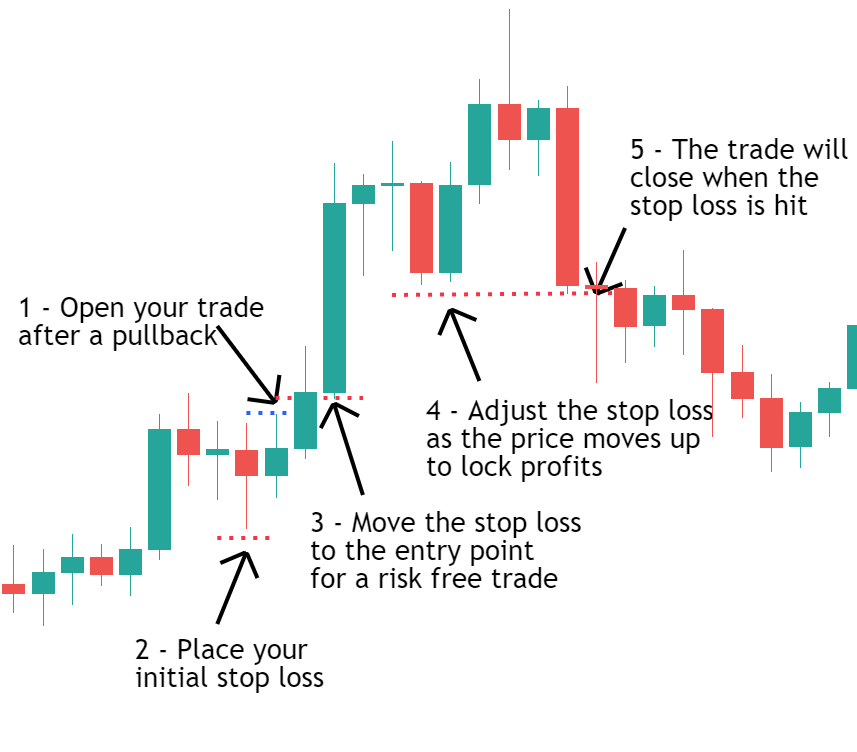

First, you need to place your initial stop loss using any of the strategies that you learned above.

When you open your trade you start negative, because you pay the spread.

At this point, you can only lock a loss with your stop loss.

But as the price starts to move in your direction, you enter into profitable territory.

And that’s when you can start locking profits.

Moving your stop loss to the other side of your order’s open price.

You can start by first moving the stop loss to your entry point.

As the price keeps moving in your direction, you keep adjusting the stop loss to lock in more and more profits.

If a target isn’t hit, your trade will close when the stop loss is hit.

This way of moving the stop loss to lock profits is called a trailing stop.

This is what it looks like in your charts:

Can I trade without a Stop Loss?

Yes!

But before that, remember:

A stop loss is a tool that helps you to manage your risk.

Trading without risk management is something that tends to work badly in the long term.

For this reason, I strongly recommend the use of a stop loss.

“Oh, but the market always returns to the same place in the future.”

Well, it can return a lot of times, but you only need one time not returning to blow your account.

“Oh, but my positions are so small that the price needs to move a lot to hurt my account seriously.”

The smaller your positions, the more time you’ll survive, but it’s just a matter of when, not if, until the price keeps going without returning before your account blows.

Some traders may survive some years without using a stop loss.

Small positions and a bit of luck help, but…

It’s just a matter of time.

Now you’re asking:

“So, how can I trade safely without using a stop loss?”

The secret is…

Trading without leverage.

This can be easily done when trading stocks, or cryptos with a cash account.

As long as you buy a small number of shares, and that position can go to 0 without making you lose a big percentage of your account, you’re good to go.

Other than that, always use your safety belt if you want to survive for a long time.

This is what you learned today

- A stop loss is an order that closes your trade once the price reaches a specific price level.

- It’s used either to lock a maximum loss as well as to lock profits as the price moves in our trade direction

- On some extreme conditions, like gaps or high volatility, a stop loss doesn’t guarantee that your position will be closed exactly at that level.

- A stop loss is typically placed on the other side of trading patterns, supply/demand zones, and moving averages.

Now I want to hear from you.

How do you use your stop loss?

Let me know below in the comments.