Everything that you need to know about the Doji candlestick pattern is here.

Today you’ll learn:

- What Is The Doji Candle

- How To Identify The Doji Candle

- Variants Of The Doji Candle

- How To Trade The Doji Candle

- This is what you learned today

- Learn More

What Is The Doji Candle

The Doji is a Japanese candlestick pattern.

It’s an indecision candle, meaning that when it appears, the price is not showing the intention to move in any particular direction.

For this reason, when you see them, it’s a good practice to stay away and wait for clear price action showing a move starting in some direction.

How To Identify The Doji Candle

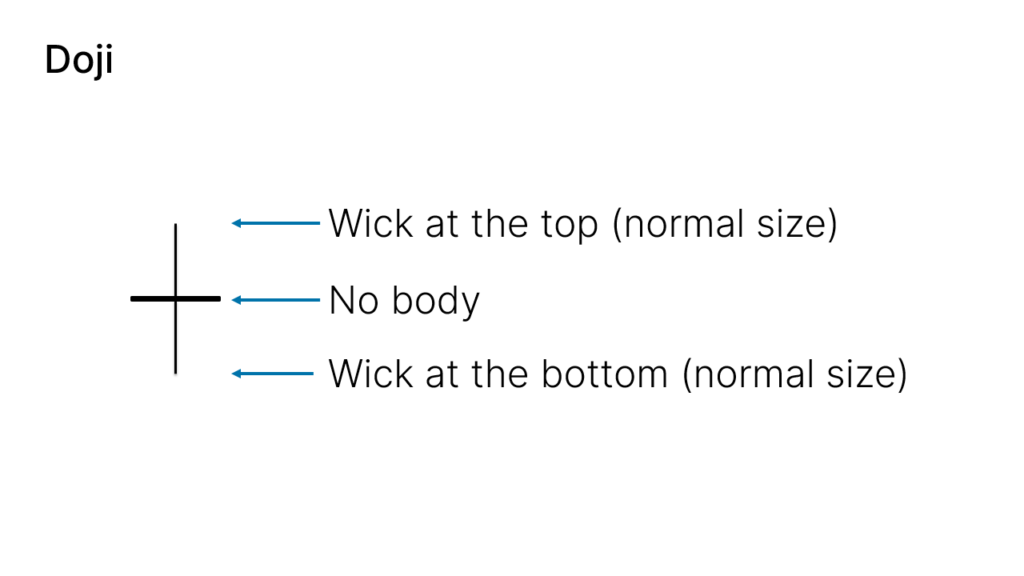

The Doji candlestick pattern is formed by one single candle.

Here’s how to identify the Doji candlestick pattern:

- A candle doesn’t have a body or is very small like 1-tick sized

- It has wicks above and below, although not big sized

It looks like this on your charts:

Variants of the Doji Candle

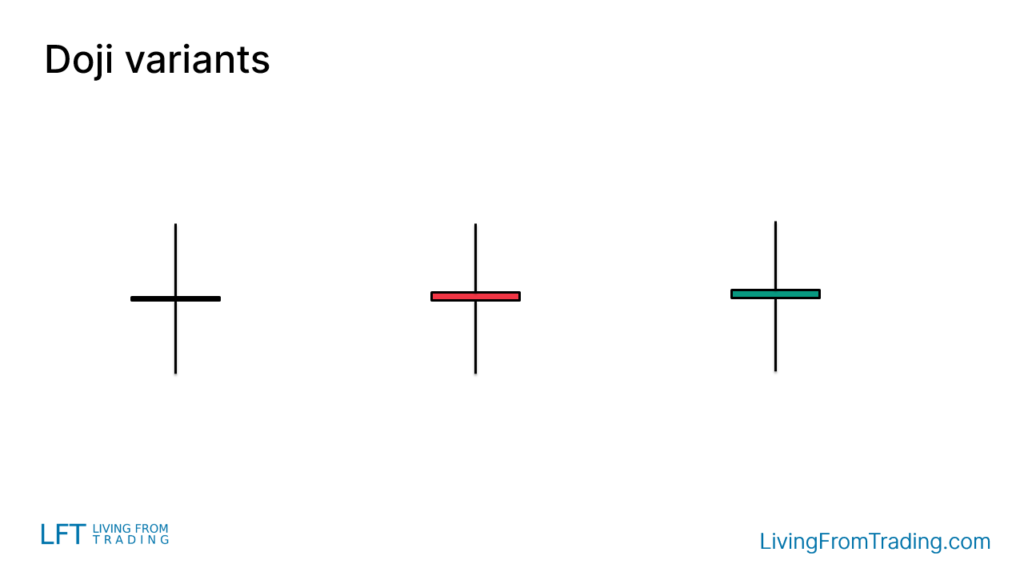

The Doji candlestick pattern may appear a little different on your charts.

The body may be green or red, the only requirement is that it’s really small.

Here’s what it may look like on your charts:

Don’t confuse the Doji candle with other very similar: the High Wave candle and the Spinning Top candle.

The only difference between them is the size of the wicks. The Doji candle is the one that has the smaller wicks. The High Wave has very big wicks. The Spinning Top is in the middle.

How To Trade The Doji Candle

The Doji candle is an indecision candle, meaning that the market is not showing anything about where it wants to go.

For this reason, while the market is undecided, we stay away and wait for at least one more candle, or pattern to appear.

Once we get more information, we can combine bullish or bearish candlestick patterns with technical indicators and trade with more confidence.

This is what you learned today

- The Doji is a single candle pattern.

- It’s an indecision candle, meaning that we should wait for further price action to take any trading decision

Now I want to hear from you.

Do you use the Doji candlestick pattern?

Let me know in the comments below.

Learn More

- List of all candlestick patterns explained