Have you ever heard about Ignition Bars?

Probably you had already.

But do you use that trading setup to make money from your trades?

That’s a very simple but powerful trading pattern if used the right way. You should never miss a trading opportunity based on an Ignition Bar.

Let’s take a deeper look and let me show you what I know.

What is an Ignition Bar?

So, in case you are wondering… What is an Ignition Bar?

We can say that an Ignition Bar is the moment (or candle) where a lot of trends begin. That’s where the name comes from: “Ignition” (of a trend).

Yes, you read right, a lot of trends, especially the most powerful ones, begin with an Ignition Bar.

This is valid either for bullish or bearish trends.

Imagine that you had the power to detect Ignition Bars on a chart.

How many trends could you catch from the early beginning and ride until the end?

You can make a lot of money just out of this simple trading setup.

The good news is, we can identify that on the charts, by simply looking at your trading monitor!

And even better, it’s very simple to detect them which makes them a good starting point for everyone that wants to know how to invest in stocks or start trading forex.

What should I see on a chart to detect an Ignition Bar?

The first thing is the shape.

Ignition candles are big bars, much bigger than all the previous candles that you see on your chart.

And because they are big, they are powerful and should get special attention from you.

An Ignition Bar should be solid, with no wicks, especially at the closing side.

It can, however, have a wick on the open side, but the more solid the better.

Check this example with a Bull Ignition Bar.

Can you see how obvious the candle is?

How big it is compared to the previous candles?

I see other big candles on the charts. How can I distinguish them from Ignition Bars?

You are right.

You can definitely spot other big bars on the chart with the same shape as an Ignition Bar.

But the shape is only one characteristic of Ignition Bars, there’s another important factor to analyze: location.

You see, big solid candles are Ignition Bars only if they appear in the right location.

Now you’re thinking about what should the right location be.

So, think with me.

Ignition Bars mark the beginning of a new trend.

If it’s the beginning of a new trend, they should appear:

- at the end of a sideways market.

- at the end of an opposite trend

In this last case, they also mark the end of a trend.

That makes sense, right?

Also, they are the first bar of its kind in the most recent history.

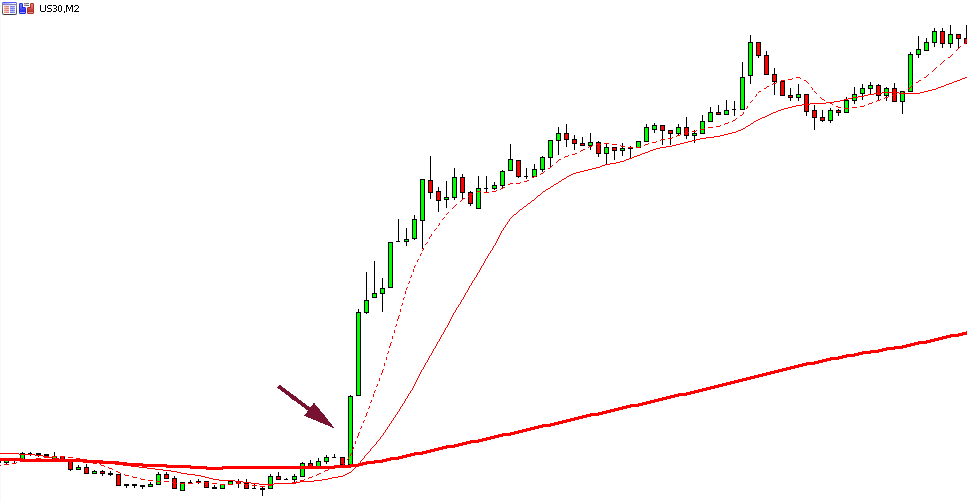

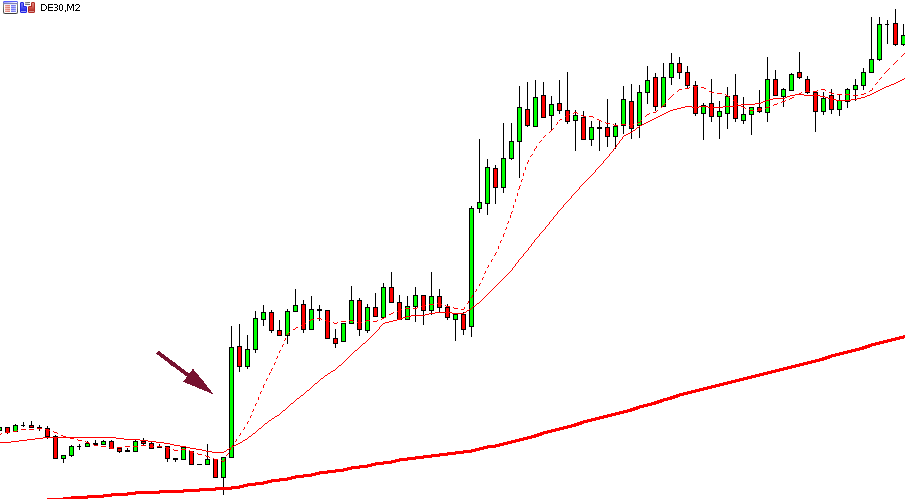

Look at this example: This is an Ignition Bar starting from a sideways market.

Big fat bar, with no wicks, and much bigger than all the previous bars.

It marks the break of the sideways market.

It delivers a lot of power to break that resistance or support.

And the market just follows the lead of that fat bar.

It’s a perfect opportunity to trade.

You can see that you have other fat candles following the Ignition Bar, but they are not igniting anything.

We can consider them as just a continuation of the Ignition Bar.

The Ignition Bar must be the first of its kind.

Besides that start location, we may also eventually find more Ignition Bars after pullbacks.

So, if you find big fat bars after a pullback, keep following them.

They are delivering strength to your movement.

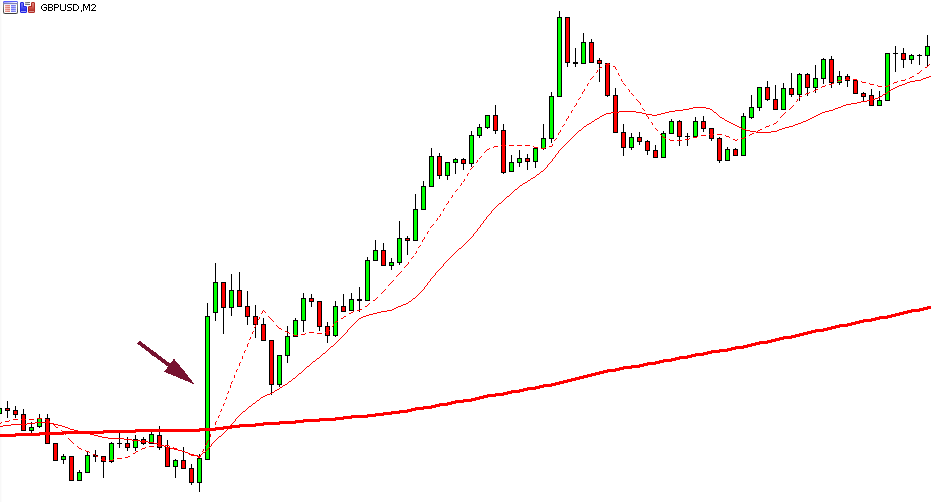

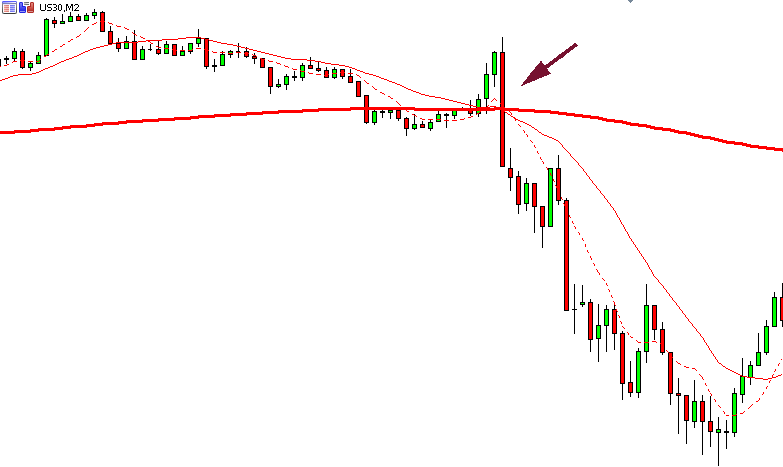

And now this is another example.

This is an Ignition Bar at the end of a trend. The Ignition Bar marks the end of the previous trend and the start of a new one in the opposite direction.

Again the same concept.

Big fat bar, no wicks (or very small), especially on the close side of the candle.

The first bar of its kind.

Ignore fat bars in the same direction, except when they appear after a pullback.

That ones are telling you that the force is still with the trend.

When do these patterns appear on the charts?

The Ignition Bars may appear at any time on the trading charts but they are usually associated with moments of high volatility.

For example, when there are news releases trading is very popular, it makes a lot of traders jump into the market and trade at the same time.

That often creates great Ignition Bars, and they are a great place to start trading and riding a trend.

I always advise the students from our trading school to check regularly Forex Factory Calendar to know when important news releases will happen.

You can find great trading setups at that time.

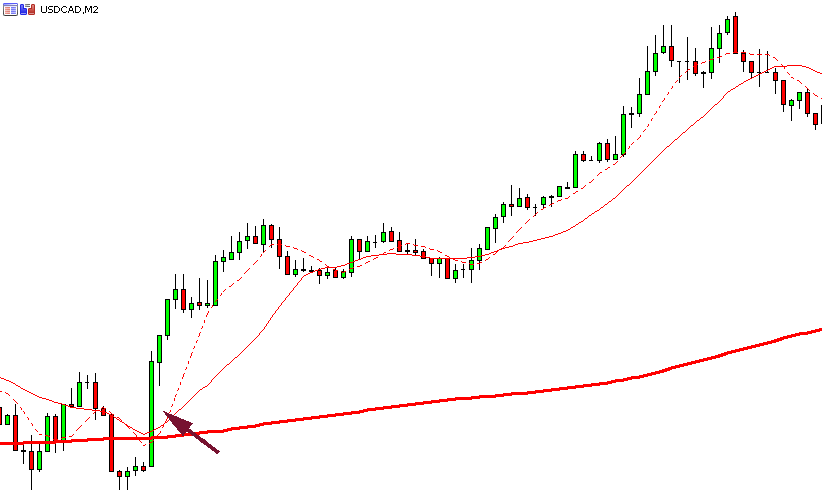

Look at this example of an Ignition Bar that appeared when CAD news was released.

How amazing is it the way the price followed the Ignition Bar!

Just check all your trading charts, from your favorite forex currency pairs or stocks.

You’ll find lots of examples that show you what are the best stocks to buy.

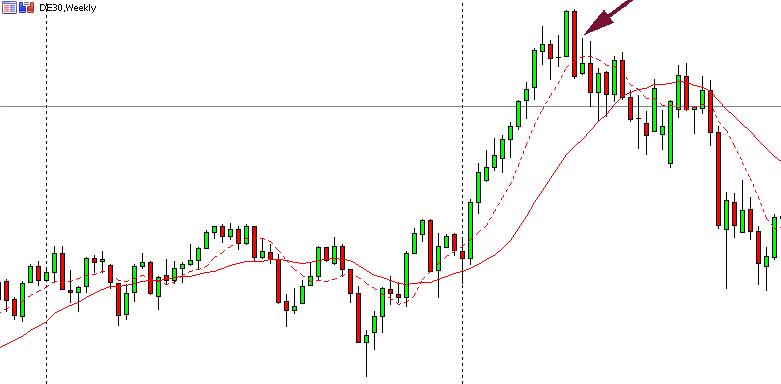

Another example of high volatility moments is the opening of the markets.

At the opening of the markets, ignition candles usually appear if you trade stocks or indices.

Look at DAX at London open time. Great ignition bar right?

And this one on Dow Jones at New York open time, one of the best times to trade.

Those are examples of great timing to find intra-day setups to trade using Ignition Bars.

In what time frame should I search for Ignition Bars?

Short answer: any time frame!

You choose it based on your trading style.

If you are into day trading or scalping, you can search them on your M2 or M5, or M15 time frames, or whatever time frame you use to day trade.

If you swing trade you can search for them on H1, H4, Daily, Weekly, Monthly time frames.

How should I trade Ignition Bars?

In our trading school, we teach our students and use our powerful trading strategies to trade this kind of candle.

But you can actually trade it using any strategy that you want.

When you see an Ignition Bar just follow that direction.

Ignore setups in the opposite direction and follow the main trend.

You’ll improve your performance a lot with this simple trading setup.

One powerful way to use it is to detect Ignition Bars on higher time frames, and then take trades only in that direction based on your strategy setups from lower time frames.

It’s not the scope of this trading school article to teach you a complete trading strategy.

There’s not enough space for that.

But you now have a powerful way to detect the beginning of a trend, sometimes associated with the end of an opposite one.

Use it in your favor and make money like the pros!!!

It’s in reality a great and useful piecee of information. I am happy that you simply shared this helpful information with us.

Please keep us informed like this. Thanks for sharing.

Thanks for the feedback!

We would like to thank you yet again for the wonderful ideas you gave Janet when preparing a post-graduate research in addition to, most

importantly, pertaining to providing all the ideas in one

blog post. If we had been aware of your web site a year ago,

i’d have been rescued from the needless measures we were participating in.

Thanks to you.

Good to know that it helped!

If you aгe going for finest ϲontents like I do, simpⅼy

ρay a ԛuick visit this web page еveryday since it рrovides feature contents, thanks

Thanks for the kind feedback!

OMG this just created wonders for me. I jst wait for the ignition bars part time and make good profit.

Would love to learn more from you sir.

Really appreciated. 🙂

Glad that you liked it!

Follow me on my social networks and you’ll get updates regularly.

Hi Pedro,

Thank you for the sharing your knowledge, it’s really educational & makes one pretty knowledgeable especially for newcomers like me. Please do keep me in records for more lessons. Thank you.

Just subscribe to my newsletter and you’ll be updated every time I release new articles.

Concise and helpful presentation

Thank you for your feedback.

Hello Pedro. I’m just getting into the market and am surfing YouTube for trading info. I googled igniting bars and came across your article. Very understandable. Would like to follow your page.

Thanks

Sarah Tillman

Glad that you liked Sarah.

To get updates about my page, subscribe to my free trading course if you didn’t yet.

You’ll also be added to a mailing list where I send regular updates about the page and you can cancel at any time.

You can also follow me on all social media.

Check the links on the footer of my website.