CFD prop firms usually focus on Forex and then have other instruments in a smaller number. That’s not the case with Crypto Fund Trader. While writing this Crypto Fund Trader review, I gladly found that they mainly focus on crypto, which is their biggest offer, and offer other CFD products on the side if you want to spice up your trading a bit more.

Before diving into the review, here’s a quick resume of Crypto Fund Trader.

REVIEW SUMMARY

Crypto Fund Trader is a Crypto and Forex prop firm, located in Switzerland. It was founded in 2024.

FEATURES

Instruments: Crypto, Energies, Forex, Indices, Metals and Stocks.

Max balance: $ 300,000

Profit split: From 50% to 90%

Cost: From $58.

Platforms: ByBit, Match-Trader and MT5.

PROS & CONS

What I like:

- Focused on crypto but also offers Forex and other CFD instruments.

- Instant funding, 1-phase and 2-phase challenges available.

- MetaTrader 5 a dn ByBit platform available.

- 1:100 leverage on advanced and ByBit accounts.

What could be improved:

- Default profit split is 80% but can be increased up to 90% with add-on.

- Student accounts only have up to 1:30 leverage (except ByBit accounts).

PROMO CODE

Now that you have skimmed the surface of this firm, let’s review the Crypto Fund Trader prop firm in depth.

Here’s what we are going to cover:

- What Is Crypto Fund Trader?

- What Can You Trade With Crypto Fund Trader?

- What Are The Crypto Fund Trader Account Sizes?

- What Is The Crypto Fund Trader Leverage?

- How Much Is The Crypto Fund Trader Payout?

- Crypto Fund Trader Reviews

- Crypto Fund Trader Programs Goals And Rules

- Crypto Fund Trader EAs/Algos/Bots

- Crypto Fund Trader Free Trial

- Crypto Fund Trader Free Repeat

- Crypto Fund Trader Coupon / Promo Code / Discount

- Crypto Fund Trader Platforms

- Crypto Fund Trader Trading Hours

- Crypto Fund Trader News Trading

- Crypto Fund Trader Payment Methods

- Crypto Fund Trader Payout Methods

- Is Crypto Fund Trader Legit?

- Crypto Fund Trader Alternatives

- Recap

- Learn More

What Is Crypto Fund Trader?

Crypto Fund Trader is a prop firm that specializes in funding crypto trading accounts, while also offering some CFD instruments to trade, like Forex.

The name of the company behind it is SWISS RLCRATES AG. It was founded in 2024 and it’s based in Switzerland.

What Can You Trade With Crypto Fund Trader?

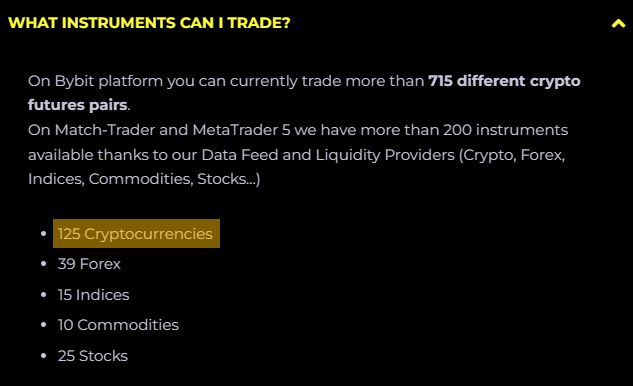

When you sign up for a crypto fund trader account, you get access to a wide range of instruments available. More than 200 at the moment I’m writing this review.

The main ones, as we know, are cryptocurrencies. There are 125 different crypto pairs available to trade.

The list doesn’t end here, though. Here’s everything that you can trade with this firm:

- Cryptocurrencies: 125 cryptocurrencies (715 crypto pairs)

- Forex: 39 pairs

- Indices: 15 pairs

- Commodities: 10 pairs

- Stocks: 25 pairs.

What Are The Crypto Fund Trader Account Sizes?

There are six different account sizes that you can choose from when trading with Crypto Fund Trader.

The smaller one starts at $5,000, and the bigger one is $200,000.

Of course, the price to get any of these accounts is different and increases with their size. To gain access to the smaller account, you need to pay $58, while the price of the bigger one costs $1,250.

What Is The Crypto Fund Trader Leverage?

There are two types of accounts. The ones with the smaller sizes ($5k, $10k, and $25k) are called the Student accounts. On the other hand, the ones with the bigger sizes ($50k, $100k, and $200k) are called the Advanced accounts. For each of these types of accounts, the leverage is different.

If you have a “student” account, the leverage is smaller.

It’s also important to notice that the leverage may be different depending on the asset type that you are trading. Here’s the leverage for each type of account and by instrument type.

Student

| Instrument | Leverage |

|---|---|

| Crypto | 1:5 (up to 1:100) |

| Energies | 1:30 |

| Forex | 1:30 |

| Indices | 1:20 |

| Metals | 1:30 |

| Stocks | 1:5 |

Advanced

| Instrument | Leverage |

|---|---|

| Crypto | 1:100 |

| Energies | 1:100 |

| Forex | 1:100 |

| Indices | 1:100 |

| Metals | 1:100 |

| Stocks | 1:100 |

How Much Is The Crypto Fund Trader Payout?

Let’s talk about what matters, how much they pay…

When you trade with Crypto Fund Trader, your profits are shared with the firm. You get a bigger cut though. 80% of the profits you make are yours. The company will keep the remaining 20% for them.

That’s a good deal in my opinion.

There’s an exception, though. When you purchase a challenge, you can also buy an add-on that gives you 90% profit split.

In the case of Instant Funding programs, the profit split starts at 50%, and increases up to 90% as you reach new steps when your account scales.

Use the button above + the code: platinum5

Crypto Fund Trader Reviews

According to Trustpilot, Crypto Fund Trader is classified as great. Everyone who reviewed the firm gave an average score of 4.5/5.0. The number of reviews is not much yet, only 890 so far.

Crypto Fund Trader Programs Goals And Rules

Now it’s time to choose which funded trader program you want to apply.

Fortunately, Crypto Fund Trader has a wide range of programs, and you’ll easily find one that fits what you’re looking for. They have 1-phase and 2-phase challenges. And good news, the instant funding program is back. Let’s review all of them.

Instant Funding Program

This program gives you a funded account immediately. There’s no challenge or evaluation to pass. The balances available are $2,500, $5,000, and $10,000. Not big, but decent for an instant funded account, and they can be scaled up to $1,280,000 if you trade consistently. They will double the size of your account every time you make 10% of profits.

The rules are simple to follow. Since there’s no challenge, there are no targets, so basically you just need to avoid a maximum daily loss and a maximum overall loss.

Here are all the details:

- Minimum trading days: 0 days, you get the account immediately.

- Maximum trading days: Indefinite, you can trade for as long as you want.

- Maximum daily loss: You cannot lose more than 4% of your account on a single day. Its calculated using the balance at the start of the day.

- Maximum overall loss: 6% static drawdown.

- Profit target: There’s no profit target to start trading the funded account.

1-Phase Program

This program gives you a funded account once you pass a 1-phase or step challenge. The accounts available for this type of program have balances from $5,000, and up to $200,000.

The rules are pretty straightforward. You need to achieve a profit target, without hitting any daily or overall losses. Here are all the details:

- Minimum days to trade: You need to trade for a minimum of 5 days, not necessarily consecutive days.

- Challenge duration: There’s no maximum time to trade, you have the freedom to trade for as long as you need to pass the challenge.

- Maximum daily loss: 4% of the daily starting balance.

- Maximum loss: 6% trailing drawdown (balance trailing), but only until you reach $6k in profit. After that it locks at the initial capital amount.

- Profit target: Just get to 10% profit, and you’ll have your desired funded account.

2-Phase Program

When trading with this program, you’ll need to pass a 2-phase challenge before you get a funded account.

Although it’s slower than the 1-phase program, there are a few advantages, like a bigger daily loss limit and max loss limit, smaller targets, and the best part, they are cheaper.

Let’s review all the details of the program:

- Minimum days to trade: You need to trade for a minimum of 5 days on each phase

- Challenge duration: There’s no maximum time to trade, you have the freedom to trade for as long as you need to pass the challenge.

- Maximum daily loss: 5% of the daily starting balance for both phases.

- Maximum loss: 10% of the initial account balance for both phases.

- Profit target (phase 1): 8% to pass to phase 2.

- Profit target (phase 2): 5% more and get funded!

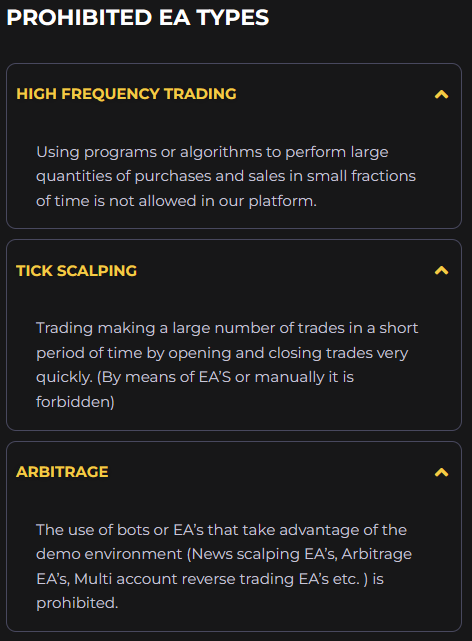

Crypto Fund Trader EAs/Algos/Bots

If you are an algo trader, this is a good firm for you. You can use your EAs to trade with Crypto Fund Trader.

Just be aware that there are some types of strategies that are not allowed, which are pretty much in the same line as other prop firms. You cannot use:

- High-frequency trading EAs

- Tick scalping EAs

- Arbitrage EAs

So, as long as your EA doesn’t try to use any of these kinds of banned strategies, you’re good to go.

Crypto Fund Trader Free Trial

There’s no free trial anymore, but you can get a good discount if you use the button below and the promo code.

Use the button above + the code: platinum5

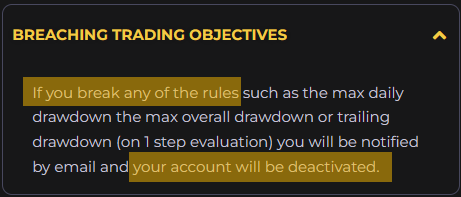

Crypto Fund Trader Free Repeat

Unfortunately, if you break any of the rules, your account will be deactivated. There’s no option for a free repeat.

Crypto Fund Trader Coupon / Promo Code / Discount

I have a discount code that Crypto Fund Trader gave me to share with my readers. Does that sound good to you?

Just use my link and then insert the code platinum5 to immediately get 5% off on your order.

Crypto Fund Trader Platforms

Crypto Fund Trader gives you access to three different platforms.

Here are the platforms:

- ByBit

- Match-Trader

- MT5

Crypto Fund Trader Trading Hours

While some prop firms don’t allow you to open or close positions during certain periods of the day, that’s not the case with Crypto Fund Trader. You are allowed to trade both overnight and over the weekend.

It wouldn’t even make sense if they didn’t allow holding positions overnight or over the weekend, especially since they are a crypto-focused firm, which is a market that never stops and runs 24/7.

Crypto Fund Trader News Trading

There are no restrictions on trading during news. Just make sure that you don’t use any of the banned EAs strategies mentioned above.

As always, remember that trading news can be risky if you don’t know what you are doing. If you love trading news like me, then you’ll know what to do, and how those high volatility moments can be so clean and easy to take a few shots in a short period of time.

Crypto Fund Trader Payment Methods

Here are all the payment types accepted by Crypto Fund Trader:

- Credit/Debit Card

- Crypto

Crypto Fund Trader Payout Methods

When you get paid by Crypto Fund Trader, you can use these methods to withdraw your profits:

- Bank Transfer

- Crypto

Is Crypto Fund Trader Legit?

Yes, they are a real company, based in Switzerland, named SWISS RLCRATES AG (CHE-162.567.204).

If you need to contact them, here are all the details:

- Email: support@cryptofundtrader.com

- Address: Bahnhofstrasse 21, 6300, Zug, Switzerland

There’s also a contact form on their website if you prefer that way.

Crypto Fund Trader Alternatives

If you’re looking for alternatives to Crypto Fund Trader, here are the best ones:

- HyroTrader review (you should definitely check this one)

- FundedNext review

- Funded Trading Plus review

For more alternatives, check our alternative prop firm tool:

Get Alternatives To Any Prop Firm

Recap

Let’s do a quick recap of this review.

- Crypto Fund Trader is a prop trading firm based in Switzerland.

- You can get a funded account with up to $300,000 in balance and an 80% profit split payout.

- To get access to a funded account, you can choose between a 1-phase or a 2-phase challenge evaluation.

- You can trade Crypto, which is the main focus, but there are also Forex and other CFD instruments available.

- You can use MT5, Match-Trader, or ByBit platforms.