We all like it when we win a lot of times in a row.

You see your account profit increasing and that’s what you want, right, profitable results?

But then there are days when you lose.

Sometimes you lose a small amount day trading, which you can recover easily.

And other times you lose a big amount.

You may lose all of your weekly profits on a single trade.

You may even lose your monthly profits on a single day with a series of consecutive losses.

Do you identify with this?

I have good news for you, it doesn’t have to be like that!

If you follow the next steps you can improve your trading.

Random results

No one can ever say that he knows what will be the result of the next trade. No one can guess the future.

The truth is that the result of any particular trade that you are going to take is always random.

All your trade results are random.

The winning trades can appear at any time.

The losing trades can also appear at any time.

It’s like flipping a coin. You never know what will be the next result.

Let’s take an example of ten trades.

Imagine that your trading strategy wins 50% of the trades and your stop loss is hit the other 50% of the trades.

When you win, you bank $100, and when you lose, your loss is $50.

Having that in mind, now let’s imagine 3 different scenarios:

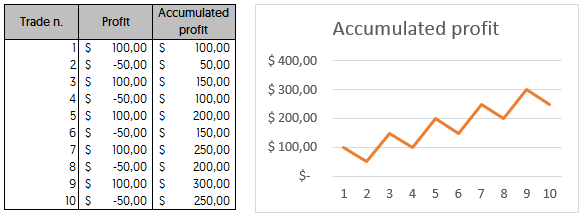

Scenario A: You have alternated wins and losses.

It means that after a win you get a loss and after a loss, you get a win.

You can see that you had a peak of $300 in profit.

But when you finish those 10 trades, you end up with a $250 profit.

The graph with your accumulated profit would be like this:

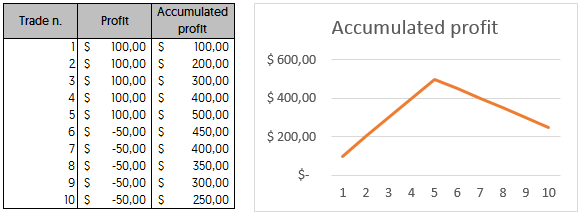

Scenario B: In this scenario, you win the first 5 trades in a row, and then you lose the next 5 trades in a row.

At some point, you have a peak of $500 in profit, but when the 10 trades are closed, you still end up with a $250 profit.

This would be the graph with your accumulated profit:

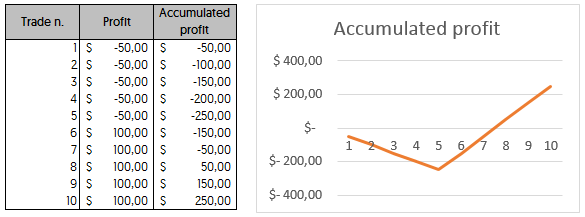

Scenario C: This is the opposite of the previous scenario. You lose 5 trades in a row and then you win 5 trades in a row.

At some point, your losses went as low as -$250, but in the end, like the other scenarios, you still get the $250 profit.

This would be the graph for this last scenario:

So, what can we conclude from these graphs?

No matter what happens between your first and last trade, if you trade the same way, after a series of trades, you’ll end up with the same final result. In this case, you would end up winning $250 on any of the scenarios.

Since your accumulated profit can go down at any point, you need to know how to calculate the maximum lot size so that your account can grow steadily without losing margin on the drawdowns or even risking blowing your account.

If you want to win this game, you need to embrace the risk. That means that you need to completely accept the outcome of any particular trade or a set of trades.

When you open a trade that doesn’t necessarily mean that you are accepting the risk. Even if you understand that you can either win or lose, you may not be accepting the risk.

You are only accepting the risk when you don’t feel any minimal signal of discomfort in your mind. When you don’t mind if you lose or win money on your next trade.

You can make an amazing analysis of the charts that you trade. You can be the best at it. But if you don’t accept the risk, if you don’t have the right mindset, you’ll always lose in the long term.

Embrace the risk, and you’ll be one step closer to success.

What external factors have an influence on the trading mindset?

You may think that the enemy is inside of us, but the enemy sometimes relies on the exterior.

External factors that can make you mess with the mindset that you should have when trading:

- If you had an argument with your wife, don’t trade that day.

- If you are upset with a friend and always thinking about that, don’t trade that day.

- If someone hits your car and you are angry, don’t trade that day.

- If your kids had bad grades at school and you are unhappy, don’t trade that day.

- If you have a big debt and need money desperately, don’t trade at all until you solve that.

All of these situations may put you out of control. If you can’t control yourself, then you shouldn’t be trading at all.

Only trade when you are relaxed and when you have peace of mind.

It’s important that you have absolutely no pressure to make money.

You need to be aware that you don’t feel like you need revenge for something that happened in your personal life. That you don’t feel like you need vengeance after you had a strike of losing trades on the market.

The market is not a place for retaliation or fighting. If you fall on that error, you’ll probably blow your account or at least have huge losses.

Learn how to read your own emotions and understand if you should be trading at some particular moment or doing something else instead.

How do I start winning trading?

You don’t need to do anything at all. Because probably you are doing more than what you should do. You are overtrading!

You don’t need to do, you need to stop doing, before you are drowning in losses.

Sometimes the day is bad to trade. Don’t push it:

- Define a maximum loss limit per day. When you reach your daily loss limit just stop trading.

- Define the maximum number of trades per day. When you reach that maximum, stop trading! Even if you didn’t reach the maximum daily loss.

The first rule that you hit, stop trading at that time.

Trading is a marathon, not a sprint, go slow.

What should be my trading goals?

You should have your daily profit targets defined in your trading plan.

But that doesn’t mean that you should trade as crazy until you achieve that target.

Look at your daily target, not as a real target to achieve, but as a trigger to make you stop trading.

When you achieve that level of profit, you just call it a day, close your charts, and go and do something else.

“Oh, but I achieved the target on the first trade, and my trading plan allows me to take up to five trades in a day!”

Yes, your trading plan allows you to take more trades, but only if you didn’t reach your daily profit or daily loss.

If you didn’t achieve that profit level, don’t push to try to reach it. If you didn’t achieve the loss level, don’t continue trading until you achieve it.

You don’t need to continue to trade if the day is bad.

You don’t even need to take any trade at all.

Accept what the market gives to you.

Learn how and when to stop trading, even if you want to continue.

Master the stop-trading mindset and you’ll see a huge improvement in your performance.

Conclusion

Trading is a game of odds. It doesn’t matter the outcome of any particular trade. It doesn’t even matter the result of any particular trading day, week, or month.

What does matter, it’s the result that you have after a big amount of trades.

When you do consistent things you have what you need to win consistently.

When you fail to follow your trading plan, the profitability will not appear.

And if it appears, it’s not real profits, it’s just luck. Those profits will soon disappear and send you to negative territory again and again. It doesn’t matter how much we try, we can only win when we have the right mindset.

When you follow your trading plan and you lose at the end of the day, that day was a win. You made what you need to be successful long term. That loss is actually making you profitable.

When you don’t follow your trading plan you just lose money. Even if the day was positive, that behavior will just ruin your account in the long term.

Does your trading plan cover what you need to be profitable?

Thank you so much, i’ve learn from you in three days what i’ve not been able to get from other trading channel and blog for months. I’m so grateful.

Trading forex vs stocks vs indices. Which one is better? has been an eye opener

You are very welcome, Ukana.