Have you ever been to hell?

I hope not…

But, when day trading…

We can experience it pretty closely.

One of the main reasons is…

Leverage abuse when trading.

But don’t get scared yet.

Let’s learn how you can use leverage to your advantage and ways to protect yourself from its dangers.

What is Leverage?

Leverage is a way to multiply your buying power by borrowing money from your broker.

You often see brokers saying that they offer a 1:5, 1:10, 1:200,…, leverage.

What does this mean?

It means that they “multiply” your account balance by that factor to give you more buying power.

Example:

Let’s say that you have $10,000 in your account and your broker gives you a 1:10 leverage to trade.

In this scenario, you could trade as if you had 10 x $10,000 = $100,000 on your account.

How much leverage can I get from my broker?

There’s no straight answer to this.

Each broker has its own rules and is regulated by a different jurisdiction which can impose limits for the maximum leverage.

Typically you get leverages within these ranges:

- Up to 1:10 if you are trading cryptocurrencies.

- Up to 1:20 if you are trading stocks.

- Up to 1:200 if you are trading indices/futures.

- Up to 1:500 or even 1:1000 if you are trading forex.

Please notice that these are just indicative values and may differ from broker to broker.

CFD’s brokers, the ones used to trade forex, tend to provide the biggest leverage.

What’s the difference between Margin and Leverage?

Margin is directly correlated to the leverage provided.

When you make a purchase, the broker will lock part of your balance to serve as margin.

Let’s say that you purchase 10 shares of a $200 stock.

If you made that purchase without leverage you would need 10 x $200 = $2,000.

Now, let’s say that your broker gives you 1:10 leverage.

This means that you can buy $2,000 worth of shares for just $200.

Those $200 will be locked while you have your position open and it’s what’s called margin.

Basically, you divide the value of the purchase that you are doing by the leverage ratio to get the margin.

$2,000 of purchase value divided by 10 = $200.

Margin often appears as a percentage.

Check this table with the correlations between leverage and margin:

| LEVERAGE (as a ratio) | MARGIN (as a transaction %) |

|---|---|

| 1:1000 | 0.10% |

| 1:500 | 0.20% |

| 1:400 | 0.25% |

| 1:200 | 0.50% |

| 1:100 | 1.00% |

| 1:50 | 2.00% |

| 1:20 | 5.00% |

| 1:10 | 10.00% |

| 1:5 | 20.00% |

| 1:2 | 50.00% |

As you can see, the lower the leverage provided by your broker, the bigger the amount that you need to lock to make a transaction.

What is a Margin Call?

First of all, you have your locked margin, which is nothing more than a guarantee that your broker gets from you.

When the overall of your positions goes deeper into red territory, your total loss gets closer to the margin amount.

When your loss is too close to the available margin that’s when you start to get into trouble.

And that’s when you may receive the “call”.

When you reach this level of loss you have three options:

- You deposit more money in your account to increase your available margin.

- You close some positions to release the margin for the others.

- You do nothing and hope for the best.

Notice that if you do nothing, the broker may start to close your positions at his own discretion.

Which of the option should you use?

Well, I would say that you should run away from having to choose between one of those options.

Instead of letting your account reach that catastrophic point, you should trade with safety.

That means:

- Plan your trades

- Place a proper stop loss

- Trade risking a small percentage of your account, using a safe lot size

But is there anything worse than having a margin call?

Unfortunately yes.

You may put yourself in a position where your broker can’t close your trades on time and you end up losing more than what you deposited.

How can you lose more than what you deposited?

This is probably the biggest nightmare of a trader.

What’s worse than blowing your account?

The need to deposit more to cover losses that exceeded your balance.

Although it’s not common, it’s a real possibility that you should be aware of and know how to protect yourself.

How can that happen?

The main reason is using a lot of leverage/margin when you probably shouldn’t.

Here are three scenarios where leverage can make you go into a negative balance:

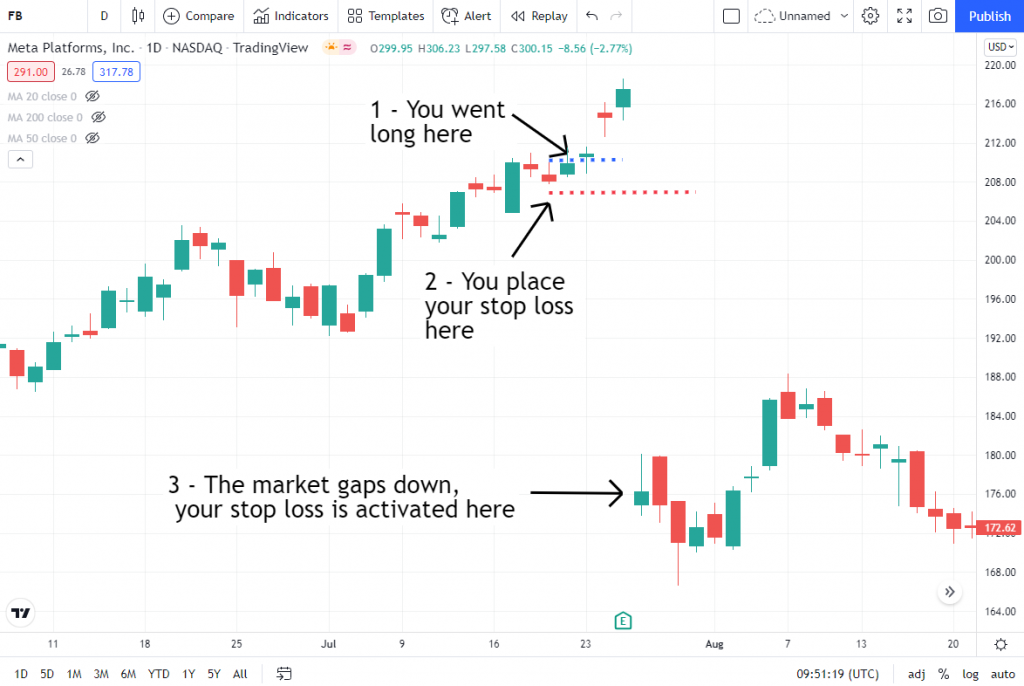

Scenario #1 – Daily/weekend gaps

This is probably the most common.

When do they appear?

Exactly when the market reopens after being closed for some time.

The bigger the time it was closed, the bigger can be the gap.

You know, when a market closes and opens on the next day, or next week, the price may have moved a lot meanwhile.

Why?

Because the trader’s sentiment may change depending on external factors.

Usually, that happens when some kind of news that was released during the close period.

And traders jump into trading the news.

Although it can work in your favor if the price gaps in your trade direction.

It can also completely wipe your account if you are using a lot of leverage and the price gaps against you.

Look at the following example.

You open a trade at the blue line.

You place a stop loss at the red line and you let your trade run.

And at some point…

The price gapped down giving you a huge loss.

And if you are using a lot of leverage, you know…

Your losses can exceed your deposits…

Daily gaps are more likely to occur in the stock market.

They don’t appear in Forex or Futures markets because they are open 24 hours a day, or only close during a small one-hour window.

Weekend gaps appear frequently in all markets that close during the weekend.

The only one that should keep you safe from these gaps is the cryptocurrency market open 24/7.

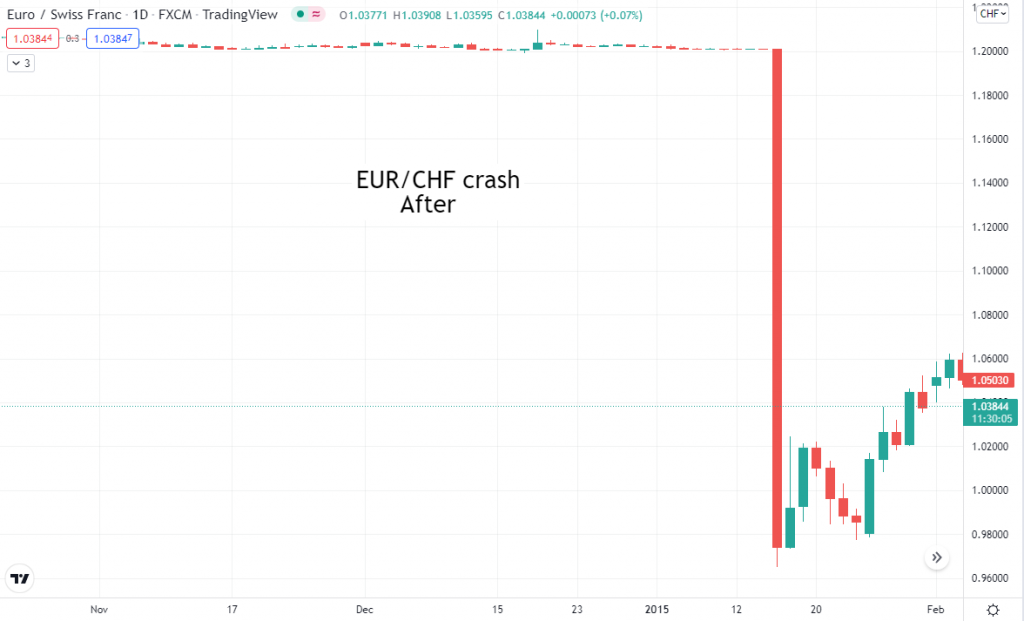

Scenario #2 – Violent market moves/crashes

One of the most famous market crashes was with EUR/CHF crash back in 2015.

The price was pegged to the EURO and being kept at levels above 1.2000 for the last 4 years.

This was being done by the Swiss National Bank, issuing millions of new money to buy the EURO and keep the peg.

During those 4 years, EUR/CHF was an easy trade.

Waiting for the price to come to the 1.2000 level and going long was the real deal there.

One morning, things didn’t go as planned.

Unexpectedly, the Swiss National Bank announced that they were abandoning the EUR/CHF peg, which immediately created a collapse of the EUR against the CHF.

This caused an instant 20% market collapse.

Famous brokers, including Alpari UK, went bankrupt.

Why?

Traders that were caught trading against the collapse, had their stop losses violated and their trades closed very far away from where they were expected.

There was a sudden sentiment reversal from bullish to bearish.

The problem here is the same, the excessive use of leverage.

Result?

There were thousands of traders with big negative balances on their accounts that couldn’t afford to pay it back to the broker.

Scary, right?

The next one isn’t better…

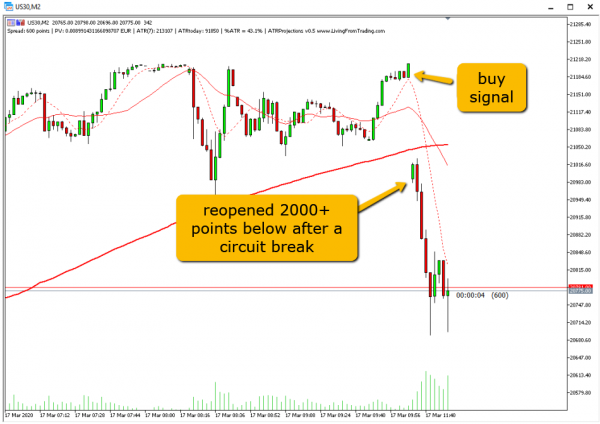

Scenario #3 – Circuit breakers

This is one of the day trader’s worse enemies.

As day traders or scalpers, we need to use a lot of leverage to be able to get decent profits from small moves.

A circuit breaker is triggered when things get overloaded, the same as our electric circuits at home.

It’s used to reestablish order in the markets when a stock or index moves too much in a short period of time.

Usually, trading is halted for 15 minutes before it restarts again.

Now imagine you are scalping Dow Jones, you go long, you set your small stop loss, and…

The chart stops moving…

Crickets…

15 minutes later the price starts moving again, with a huge gap, and it triggers your stop loss way below the level where you had it.

This example happened during the covid crash.

How bad can your account be hurt if you get a loss 10x bigger (or more) than what you planned initially?

Pretty bad…

But there are some measures that can help you avoid these events.

Here they are:

How to avoid negative balance events

- Be aware of news releases, specially after the market close or during the weekend. This can easily change the traders/investors market sentiment and make the price open with huge gaps.

- Reduce leverage/risk during market crashes like the one we had during the 2020 covid crash.

- Reduce the time exposed to the market. The bigger the leverage that you’re using, the less time you should have your trades open.

- Don’t use leverage at all – Although the previous points should be able to keep you safe enough, avoiding leverage is the only way that guarantees that this situation will never happen to you.

Pros and cons of leveraged trading

Although leverage can be hell, it can also be heaven.

If leverage didn’t exist you wouldn’t see anyone day trading for a living.

Here are a few pros and cons regarding leveraged trading:

Pros

- You can trade small moves (day trading or scalping) and get decent profits from them.

- When you’re a consistently profitable trader your account can grow faster.

Cons

- You pay interest fees to your broker.

- You may get bigger losses.

I’m scared, should I stop using leverage to trade?

No way, specially if you are a day trader.

Don’t get me wrong, I absolutely love leverage.

It’s not possible to make a decent amount of profit day trading without the use of leverage.

And this is even more valid if you are a scalper.

You need to use leverage because as a scalper you go after just a very small amount of ticks, points, or pips.

The only way to make that small market move be equivalent to a decent amount of money is to multiply your account balance using leverage

The key is to avoid risking a big percentage of your account per trade.

As a general rule, the bigger the leverage you use, the less time you should be exposed to the market.

Here’s what you learned today

- Leverage is the number of times that your broker multiplies your account equity to lend you money to trade.

- Margin is the amount of money that gets locked in your account each time that you open a trade.

- When your losses get close to your margin level, your broker may close your trades (margin call) unless you deposit more money or close trades yourself.

- How you can lose more money than what you’ve deposited and how you can trade defensively against that.

Now, I want to hear from you.

What do you think about leverage and how do you use it?

Just tell me below in the comments.

Dear Pedro,

Excellent explanation on LEVERAGE,with examples..

Margin call very clear to me..

Your explanations are much clearly than what my Broker has told me

Appreciate your great work

Thanks

Glad to know it helped you, Mahesh.

I wish you a lot of success on your trading.